Corporate Tax Policies and Their Impact on Global Emissions

In a bid to attract foreign investment, many nations have historically slashed corporate tax rates, leading to a competitive downward spiral. This phenomenon prompted the OECD countries in 2021 to endorse a global minimum tax policy. A recent multi-country, multi-industry general equilibrium model has shed light on the broader implications of such tax strategies, particularly in relation to global carbon emissions and the economic welfare of developing economies.

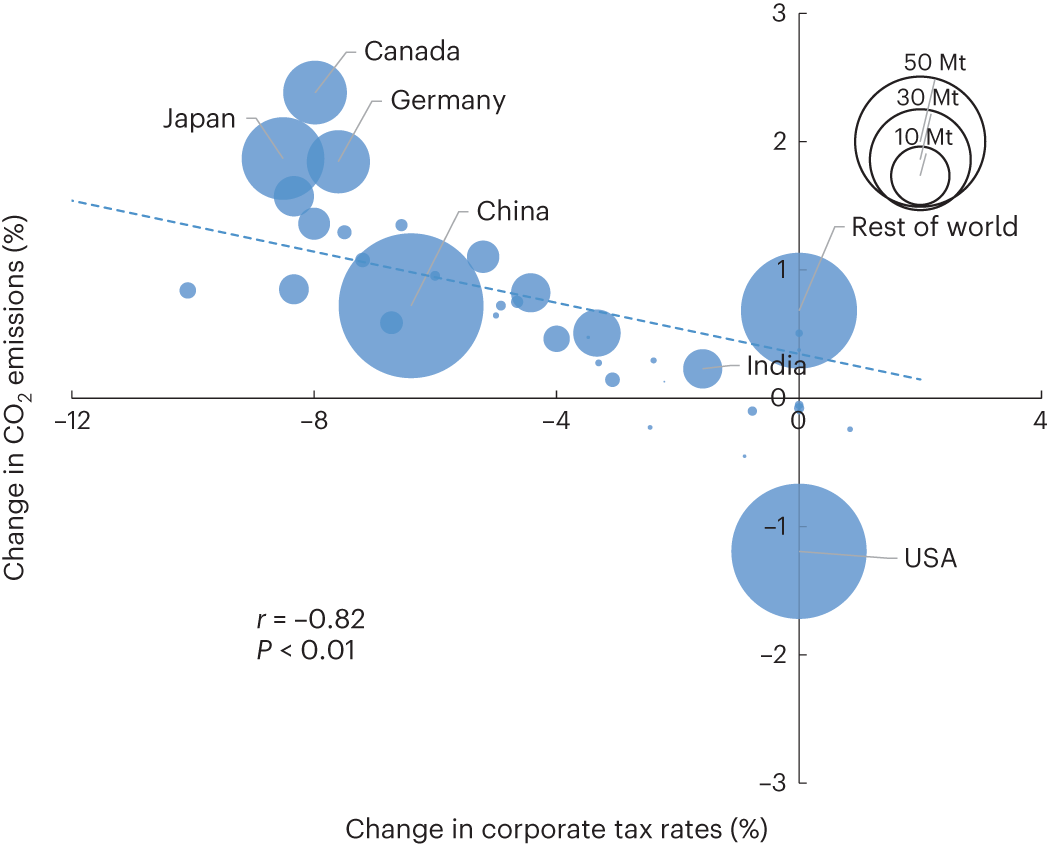

The study, which scrutinizes the period from 2005 to 2016, reveals that corporate tax competition has inadvertently increased global carbon emissions. More alarmingly, it has disproportionately shifted the burden of these emissions onto developing countries. However, the implementation of a 15% global minimum tax rate could potentially reverse this trend, leading to a reduction in global carbon emissions and alleviating the environmental pressures on developing economies.

The findings underscore the intricate link between fiscal policies and environmental outcomes. They suggest that corporate tax rates are not just tools for economic stimulation but also have significant implications for global climate change mitigation efforts. The research advocates for a harmonized approach where corporate tax policies are aligned with climate regulations to foster sustainable economic development without exacerbating carbon footprints.

Access to the full study and its supplementary information is available through various institutional and subscription-based channels. The research has been recognized for its contribution to understanding the complex dynamics between international tax competition and environmental policy.

The authors of the study, affiliated with prestigious institutions across China and the United States, have expressed gratitude for the financial support received from various Chinese foundations. They have also extended special thanks to research assistants from the Central University of Finance and Economics in China for their exemplary work.

As this research navigates through peer review, with contributions from experts like Luis Lopez, it stands as a testament to the ongoing efforts to integrate economic policies with environmental stewardship. The study’s publication in Nature Climate Change is expected to stimulate further discourse and policy action in the intersecting realms of taxation and climate change mitigation.