Bank of Cyprus Spearheads ESG Initiatives

In a bold move to combat climate change and enhance sustainability, the Bank of Cyprus (BOC) is taking significant strides in the realm of Environmental, Social, and Governance (ESG) pillars. With the World Meteorological Organisation (WMO) declaring 2023 as the warmest year on record, BOC’s commitment to ESG principles is more crucial than ever.

Aligning with the European Union’s ambitious goal to reach net-zero emissions by 2050, BOC has set a target to become carbon-neutral by 2030. This involves a substantial reduction of 42 percent in Scope 1 and Scope 2 greenhouse gas (GHG) emissions from their 2021 levels. Thanks to energy-efficient measures implemented over the past two years, such as boiler upgrades and solar panel installations, the bank has already achieved an 18 percent reduction.

Further investments are planned for the next two years, focusing on replacing fuel-intensive machinery and vehicles, which are expected to contribute an additional 3-4 percent reduction in GHG emissions. BOC is also exploring other actions to achieve a further 30 percent reduction by 2030.

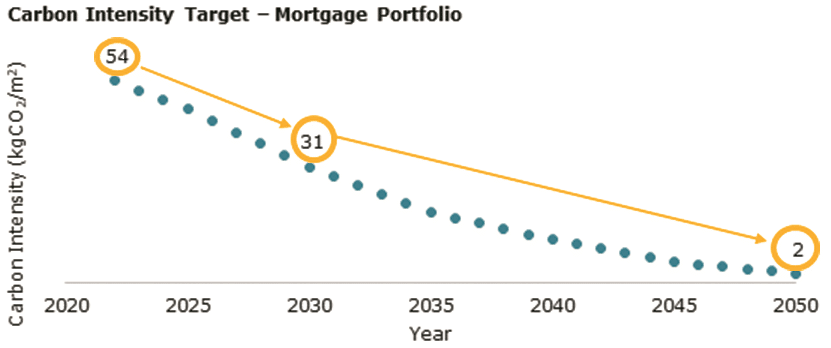

To facilitate Cyprus’ shift to a low-carbon economy and manage transition risks, BOC has taken a proactive approach by setting a GHG emissions reduction target for its Mortgage portfolio. The goal is a 43 percent decrease in emissions per square meter financed by 2030, in line with the International Energy Agency’s Below 2 Degree Scenario.

The introduction of the “Green Housing” product, compliant with the Green Loans Principles, marks a significant step in the bank’s decarbonisation strategy. BOC is also assessing additional decarbonisation targets across various asset classes to support its customers’ low-carbon transition.

Recognizing that certain sectors pose higher transition risks, BOC has implemented sector lending limits to reduce exposure to carbon-intensive industries. The bank’s focus extends to engaging with customers, offering education on sustainability, and providing green financing options.

Moreover, BOC has conducted a comprehensive Business Environment Scan and materiality assessment to identify climate-related and environmental risks. This has led to the establishment of new Green/Transition lending targets for 2024, aimed at supporting Cyprus’s transition while managing sector-specific transition risks.

In response to physical risks such as wildfires and floods, BOC has utilized geolocation data on collaterals and other assets to design effective mitigation strategies. Additionally, an ESG Due Diligence process has been established to evaluate customers’ ESG and climate risk performance, further solidifying the bank’s commitment to sustainability.

As part of the broader Cyprus Banking industry initiative, a common platform is being developed to assess customer ESG factors, which will provide actionable insights for performance improvement.

For more information on the Bank of Cyprus’s ESG initiatives or to engage with their services, interested parties can visit www.bankofcyprus.com, email [email protected], or call 800 00 800 domestically or (+357) 2212 8000 from abroad.