Mark Cuban Embraces Tax Day with Patriotic Fervor

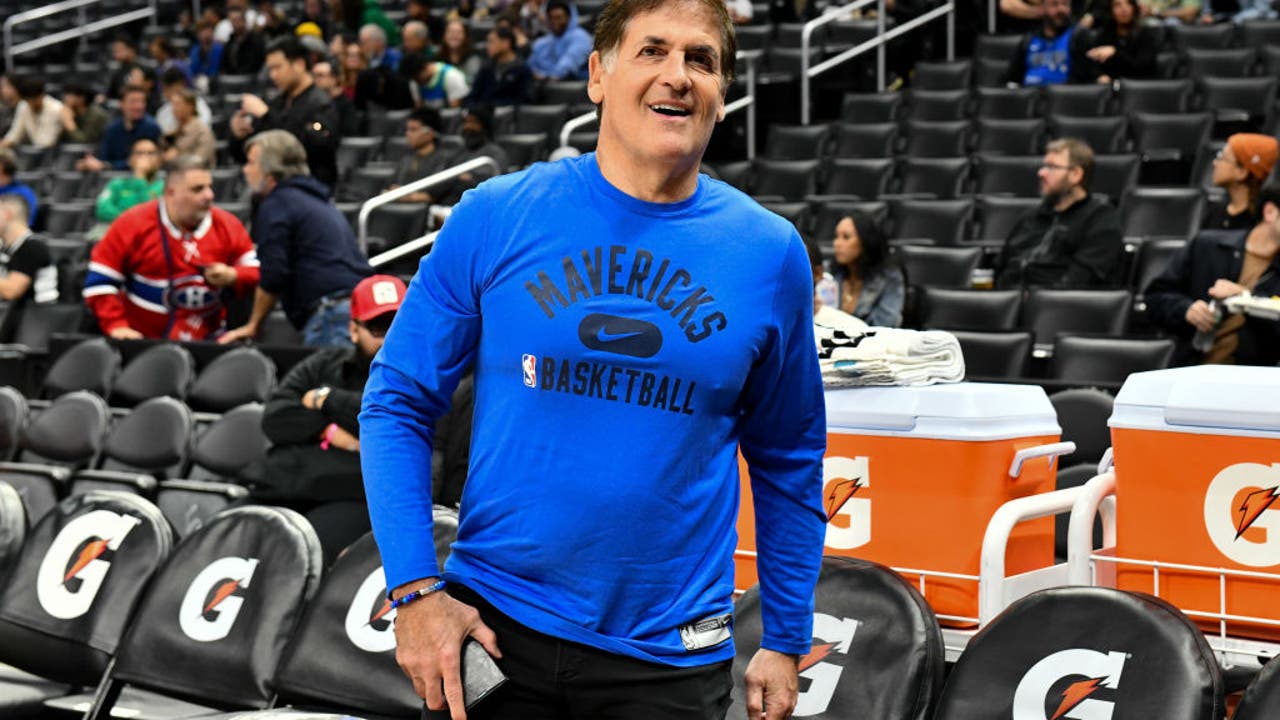

As the nation marks tax day, billionaire entrepreneur and Dallas Mavericks minority owner Mark Cuban has expressed his readiness to fulfill his civic duty. Attending a basketball game in Los Angeles, Cuban shared his sentiments on the significance of tax payment, a gesture that resonates with his deep sense of national pride.

“This country has done so much for me, I’m proud to pay my taxes every single year,” Cuban stated in a social media post that accompanied his presence at the Crypto.com Arena. His initial declaration of a $288 million tax payment was later revised following a consultation with accounting firm KPMG. The corrected figure emerged amidst a heated online debate regarding corporate tax cuts, highlighting Cuban’s engagement with fiscal matters both personally and publicly.

Cuban, who is no stranger to the spotlight, often shares his views on various national issues. He emphasized the importance of taxes by equating them with military service in terms of patriotic acts, saying, “after military service, paying your taxes is the most patriotic thing we can do.”

The conversation around Cuban’s tax contributions follows his significant business move last year, where he sold his majority stake in the Dallas Mavericks to the Adelson family for a staggering $3.5 billion. This transaction has undoubtedly impacted his tax considerations and showcases the intersection of high-stakes business dealings with civic responsibilities.

As tax day unfolds, Cuban’s stance serves as a reminder of the role that individuals, especially those in the upper echelons of wealth, play in contributing to the nation’s fiscal health through their tax payments.