Examining the Impact of Tax Policies on Middle-Class Families

As Tax Day casts its shadow across the nation, it brings into sharp focus the political maneuvers that could shape the financial landscape for American families. A particular point of contention is the stance of Jen Kiggans and her fellow House Republicans, who are accused of aligning with former President Trump’s vision of a tax system that favors the affluent.

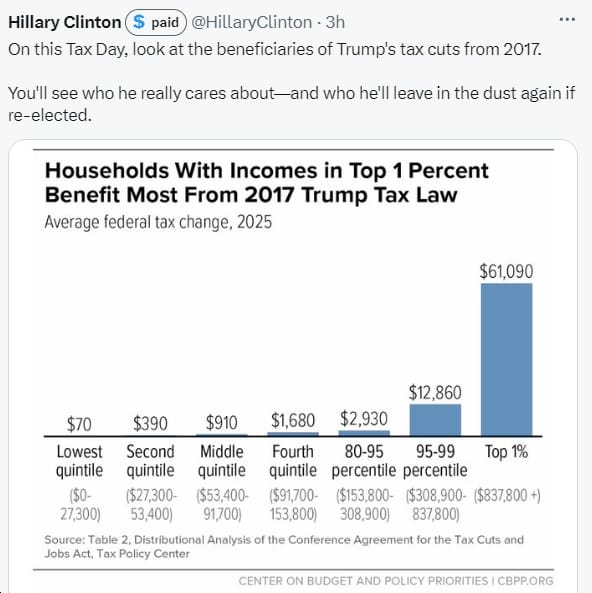

The 2017 GOP Tax Scam is often cited as a pivotal moment where corporate interests were allegedly prioritized, with significant tax cuts being funneled towards the wealthiest individuals. Critics argue that this legislation placed an undue burden on middle-class families, who were left to shoulder the financial responsibilities that come with such top-heavy benefits. Donald Trump’s current tax proposals seem to follow a similar trajectory, purportedly aiming to further reduce taxes for billionaires.

Despite these assertions, Jen Kiggans and her colleagues appear ready to defend their tax policy choices, potentially extending the principles of the 2017 tax overhaul if they secure another term in power. This position seems to clash with public sentiment, as recent polls indicate a strong preference among Americans for a tax system that imposes greater obligations on the ultra-rich and large corporations. The goal, according to many constituents, is to foster an economy that grows from the middle-out and bottom-up.

DCCC Spokesperson Lauryn Fanguen expressed concerns about the direction of these tax policies:

The debate over tax reform continues to be a divisive issue, with many arguing that the current trajectory could exacerbate economic disparities. As election cycles heat up, the conversation around taxation is likely to remain at the forefront of political discourse, with middle-class families keenly watching how their interests will be represented in future legislation.