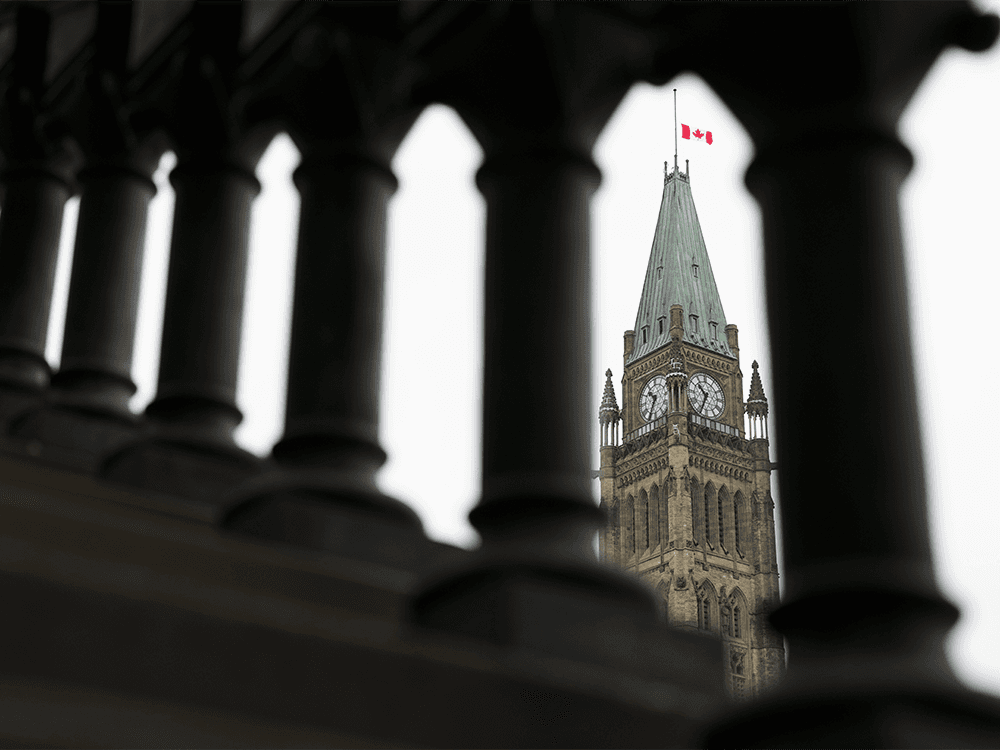

Upcoming Federal Budget Raises Concerns and Expectations

As the federal Liberal government prepares to unveil its new budget, Canadians are left to speculate on its contents amidst a climate of strategic leaks and political maneuvering. The once-sacrosanct practice of budget secrecy has eroded, leaving many to question the fairness and integrity of the process.

In anticipation of the budget release, Kim Moody, a respected voice in the tax community, has expressed concerns over potential policy changes. Housing, a hot-button issue due to shortages and soaring rents, is expected to be a focal point. The government’s housing plan, released last week, has been criticized for lacking detail on addressing foundational issues such as immigration, inflation, and labor shortages.

Moody also anticipates clarification on previously announced Alternative Minimum Tax changes, which could significantly impact charitable giving. While personal tax increases seem unlikely, Moody wouldn’t be surprised by subtle policy shifts targeting high-income earners—a trend in recent years.

Corporate tax hikes and an “excess profits tax” are on Moody’s radar as well. He argues that such measures would harm Canada’s competitiveness and do little to address the country’s productivity challenges. Moreover, he warns against the negative signals these taxes could send to investors.

The capital gains inclusion rate and the introduction of new personal tax credits are also areas of interest. Moody notes that while new credits might appeal to voters, they complicate the tax system and increase administrative burdens.

Of paramount concern to Moody is the ballooning public-debt charges, which are nearing the total annual GST revenue collection. He emphasizes the importance of a budget that not only plans for the future but also ensures financial stability for coming generations.

Kim Moody’s insights reflect a broader sentiment among Canadians who seek a budget that balances fiscal responsibility with the needs of society. As the budget day approaches, all eyes will be on the government’s plan to navigate these complex economic waters.

Moody, with his extensive background including leadership roles in the Canadian Tax Foundation and Society of Estate Practitioners (Canada), invites further discussion on these pressing issues as Canadians await the full disclosure of the federal budget.