Signs of Recovery in the UK Economy as GDP Grows

The UK economy has shown signs of resilience as it steps out of a recessionary phase, bringing a glimmer of hope to traders and investors. Recent data indicates a modest GDP growth of 0.6%, which, although slight, surpasses the anticipated forecast of 0.4%. This positive development has been met with optimism in financial circles, as it suggests a potential turnaround from the prolonged economic downturn.

Despite the encouraging signs, there remains a degree of caution regarding the implications for monetary policy. With inflation rates still considerably higher than the Bank of England’s targets, there is speculation about whether the central bank will maintain higher interest rates, mirroring the Federal Reserve’s approach. Nonetheless, Governor Andrew Bailey’s recent comments suggest that interest rates may fall more sharply than expected, providing some reassurance to those concerned about the cost of borrowing.

In currency markets, the sterling has seen an uptick against the dollar index, though this rise is expected to be restrained. The initial surge in sterling’s value is likely to stabilize as market excitement settles and broader currency trends resume.

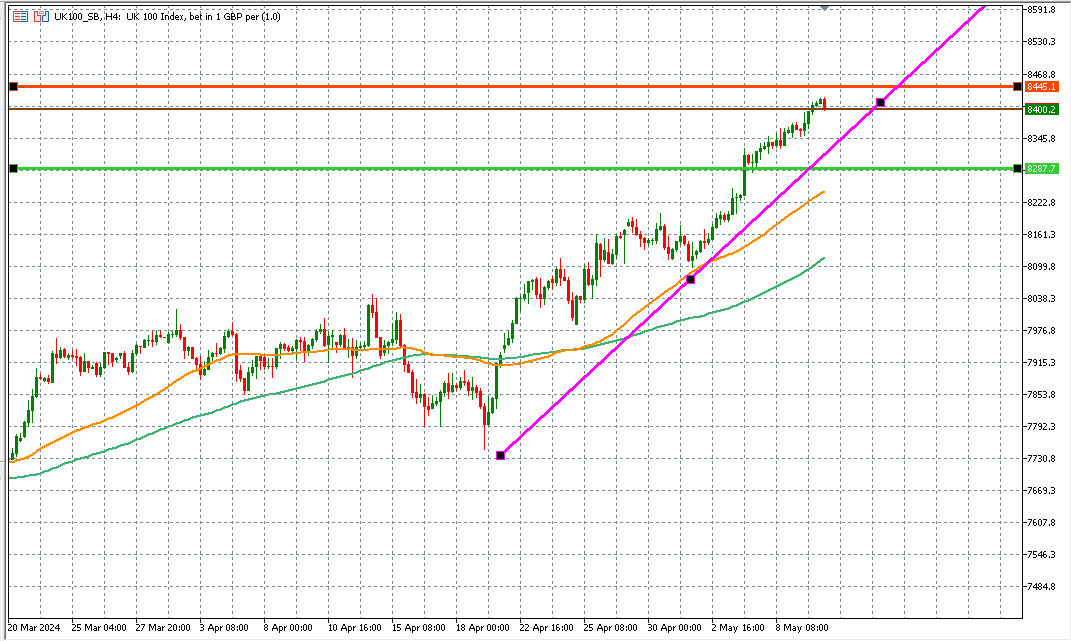

As for the FTSE 100, the sentiment is clear: any news is good news. The index has demonstrated strength, with price action remaining above both the upward trend line and key moving averages, indicating that bullish forces are currently dictating market dynamics. However, investors are advised to exercise caution and not be overly swayed by short-term movements. The underlying fundamentals of the UK’s economy still show signs of weakness, and a market pullback could lead to significant corrections.

Traders are closely monitoring support and resistance levels, with immediate support at the purple trend line. A breach here could lead to further testing of support at the green line. Conversely, resistance looms near the red line, which could cap further gains in the index.

With economic growth on a tentative upswing, market participants remain watchful of indicators that could signal sustained recovery or hint at potential setbacks. As the UK navigates its monetary policy in this delicate phase, the balance between fostering growth and controlling inflation will be pivotal.