Understanding the Impact of Gross Receipts Tax on Businesses

The landscape of corporate taxation in the United States is complex, with various states adopting different approaches to raising revenue. One such method is the gross receipts tax (GRT), which has been a topic of debate among policymakers and business leaders. The GRT is levied on a company’s gross sales without allowing deductions for business expenses, leading to what is known as tax pyramiding—a scenario where the same final good or service is taxed multiple times along the production process.

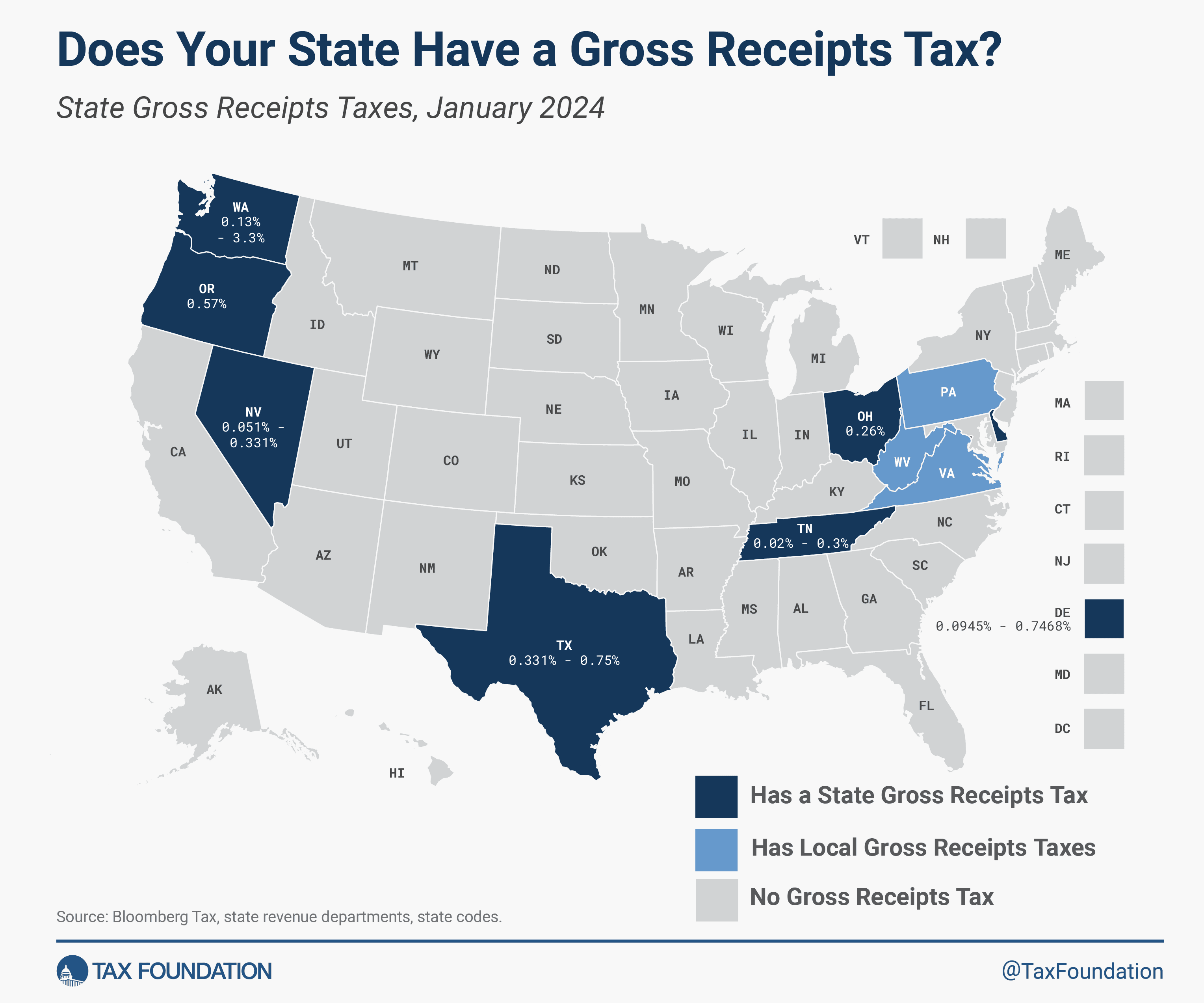

Currently, seven states impose a state-level GRT, with others allowing local municipalities to assess similar taxes. These taxes are not new; they date back to medieval Europe and saw a resurgence during the Great Depression in the United States. However, modern research and historical sentiment have deemed them economically detrimental, leading to their elimination in most states.

States that still employ GRTs often provide carveouts, such as credits, deductions, or exclusions, to mitigate some of the tax’s negative effects. For instance, Tennessee boasts the lowest GRT rate at 0.02 percent, while Washington’s Business and Occupation (B&O) Tax can reach rates as high as 3.3 percent. Nevada’s Commerce Tax exempts the first $4 million of gross revenue for small and medium-sized businesses but presents structural issues when combined with the state’s payroll tax.

Recent legislative changes in states like Oregon and Ohio reflect attempts to alleviate the burden of GRTs on small businesses by increasing exclusion amounts. However, these adjustments also highlight the ongoing challenge of balancing tax relief with the need for revenue.

For businesses operating as an LLC in Georgia, understanding the nuances of Georgia LLC taxes is crucial. The Georgia Secretary of State LLC division provides resources for businesses to navigate their tax obligations. It’s essential for LLC owners to consult with the tax authority and learn how to do your taxes effectively to ensure compliance and optimize their tax positions.

While gross receipts taxes remain contentious, the trend towards their reduction or elimination suggests a shift towards more business-friendly tax policies. As states continue to refine their taxation strategies, businesses must stay informed and adapt accordingly. For those seeking guidance on how to do taxes, resources from the Georgia Secretary of State LLC office and other state agencies can provide valuable assistance.