GBPUSD Sees Modest Gains Amid Fluctuating Currency Exchange Rates

The currency exchange rate landscape witnessed the Pound Sterling starting the week on a positive note against the US Dollar. The GBPUSD pair saw a slight increase of 0.04% after it dipped to a daily low of 1.2681, with trading stabilizing later at around 1.2703.

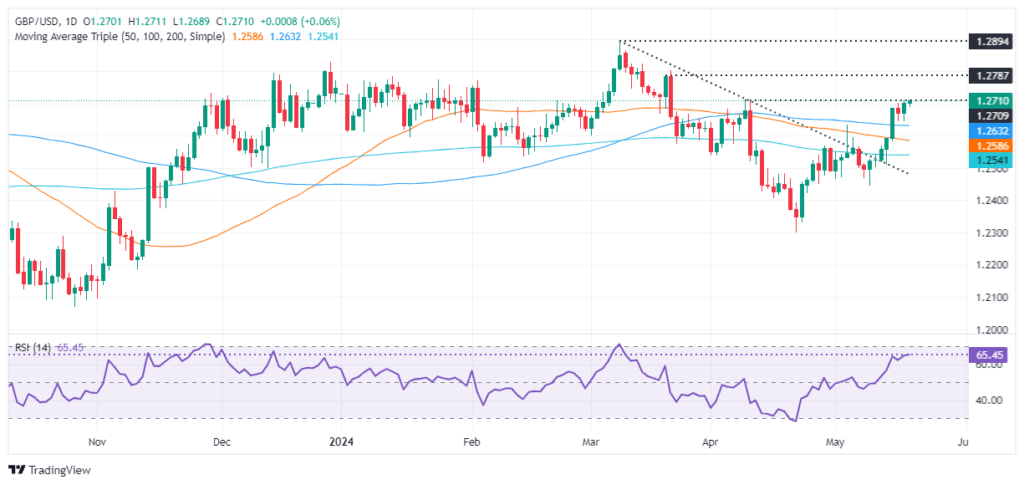

Last week’s performance showed the GBPUSD pair approaching the current exchange rate with determination, successfully breaching significant resistance levels such as the 50 and 100-day moving averages (DMAs). This breakthrough has seemingly paved the way for potential further gains. The Relative Strength Index (RSI), a momentum indicator, suggests that buyers currently have the upper hand, although it’s important to remain cautious of potential downside risks.

To maintain its bullish trajectory, it is crucial for the GBPUSD to sustain a level above 1.2700. Should this hold true, the pair may encounter its first notable resistance at the March 21 cycle high of 1.2803. Surpassing this could lead to a confrontation with the year-to-date high at 1.2893, which lies just before the significant 1.2900 threshold, eventually aiming for the psychologically important 1.3000 mark.

On the flip side, should the GBP/USD spot price fall below the 1.2700 support level, it might trigger a retest of the confluence formed by the 100-DMA and the May 3 high at 1.2634. A breach below this point could open up possibilities for further declines towards 1.2594 and then to the 50-DMA at 1.2584, with a potential slide extending down to the 200-DMA at 1.2539.

The currency markets remain vigilant as these levels are tested, with traders and analysts closely monitoring the GBPUSD’s performance on platforms like TradingView, as indicated by the provided daily chart from OANDA.