Net operating loss (NOL) tax provisions in Europe are set to undergo significant changes in 2024, impacting how businesses manage their financial health through tax code mechanisms like loss carryovers and deductibility limits. These provisions allow companies to offset their losses against past or future profits, helping to stabilize their tax liabilities over time.

Carryforward and Carryback Provisions

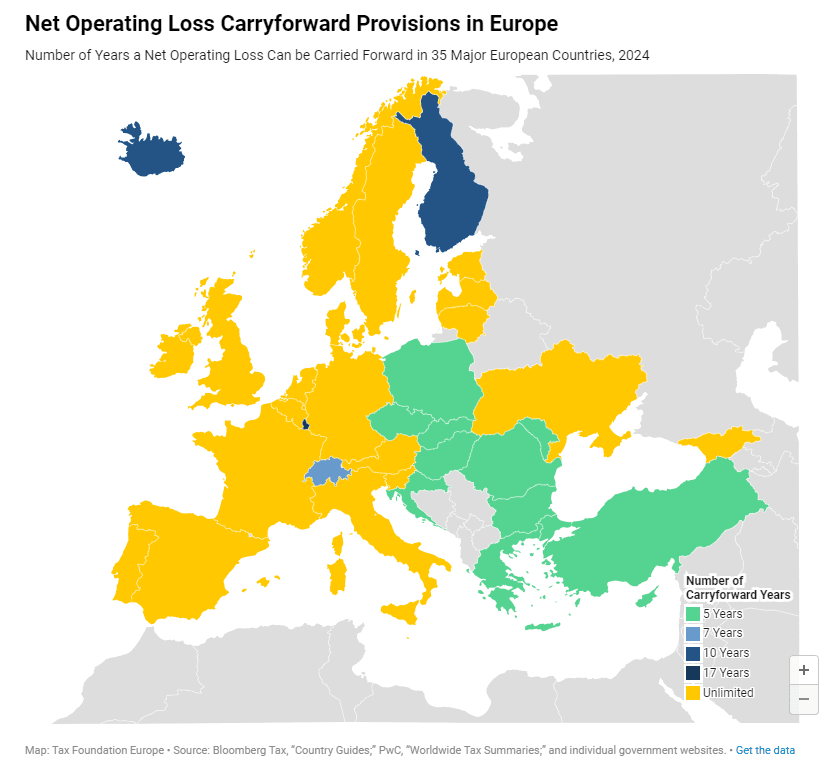

Twenty out of the 35 European countries analyzed permit businesses to carry forward their NOLs indefinitely. Luxembourg offers the most generous time limit among the remaining countries, allowing a 17-year carryforward period. On the other end of the spectrum, Bulgaria, Croatia, Cyprus, the Czech Republic, Greece, Hungary, Moldova, Poland, Romania, Slovakia, and Turkey restrict carryforwards to just five years. For comparison, the United States allows businesses to carry forward their NOLs indefinitely but caps the deductible amount at 80 percent of taxable income.

When it comes to carryback provisions, European countries are generally more restrictive. Only nine countries allow carrybacks, with Estonia, Georgia, and Latvia being the most lenient by offering them without a time limit. The United States currently does not permit businesses to carry back losses.

Unique Tax Systems

Estonia, Georgia, and Latvia employ a “cash-flow tax” system, which taxes businesses only when profits are distributed to shareholders. This system effectively allows for indefinite loss carryovers without explicitly stating so. Cash-flow tax systems also mitigate adverse incentives that might arise from more generous loss carrybacks.

Deductibility Limits

Several countries impose deductibility limits on loss carryovers. For instance, Italy restricts loss deductions to 80 percent of taxable income. Recent changes in 2024 reflect a dynamic landscape: Belgium has increased its deductibility limit for loss carryforwards from 40 percent in 2023 to 70 percent. Conversely, Romania has reduced the carryforward period from seven to five years and introduced a 70 percent deductibility limit. Germany has relaxed its deductibility limit from 60 percent to 70 percent for about half of corporate income tax liabilities but has also reduced the maximum carryback amount from EUR 10 million to EUR 1 million.

These evolving tax provisions underscore the importance for businesses to stay informed and adapt their financial strategies accordingly.