European and US futures are trading with extreme caution on Wednesday as traders are reluctant to make any big moves ahead of two important events. Observing the day’s price action reveals a tense atmosphere, because the US CPI report and the Fed’s monetary policy decision, followed by their press conference, are going to govern the momentum.

So far, since Friday, traders and investors have been busy digesting the NFP jobs data, which brought a different message for market players, especially when comparing that economic print with the rest of the numbers we have seen earlier.

Expectations

On Friday, a number of experts argued that the NFP data plays a crucial role in the Fed’s monetary policy decision, while the US CPI data holds less importance. Their argument has been based on one thing: if the US labour market is strong, the Fed isn’t worried about fine-tuning their monetary policy in either direction or keeping it the same, as the labour market is strong.

Traders and investors are increasingly concerned about the Fed dot plot, with the number of interest rate cuts this year being their primary concern. Following the release of the NFP data, many anticipate a single rate cut this year. Additionally, market participants anticipate a more hawkish stance from some Fed members in the dot plot, potentially indicating a vote for one more rate hike.

One Door Closed, One Door Opened

Wednesday’s event is important in terms of two possible scenarios. If the US CPI print fails to impress markets by a significant margin, one can easily assume that the door for three rate cuts will definitely close. A disappointment in the CPI data will open the door, and there is a strong possibility of another rate hike—a scenario that market players haven’t factored in at all, despite its critical importance.

Another Sunak Failure

While the Russian economy, despite thousands of sanctions, has been able to produce GDP growth of over 3%, Rishi Sunak’s government continues to face more failures. Thursday’s GDP data brought further bad news for PM Sunak, as the GDP m-o-m indicates that the economy is once again on the verge of entering a recession, with a reading of 0.0%.

Despite the headlines blaming the rainy season for keeping consumers indoors and preventing them from spending, it’s important to remember that the UK isn’t a Mediterranean region, where consumers are accustomed to sunny, bright weather, and when it rains, they tend not to go shopping. You simply cannot attribute a poor GDP number, which has begun to flirt with recession, to the weather.

The reality is that everyone in the country, whether an average Brit or a business owner, is struggling to make ends meet. The lack of safety in the country is apparent, with London streets becoming unsafe for people to walk on due to the constant threat of phone or bag snatching. Car insurance and other insurance products are taking more money out of consumers’ pockets, and food inflation continues to remain a huge problem. Sunak’s government persists in its haughty stance.

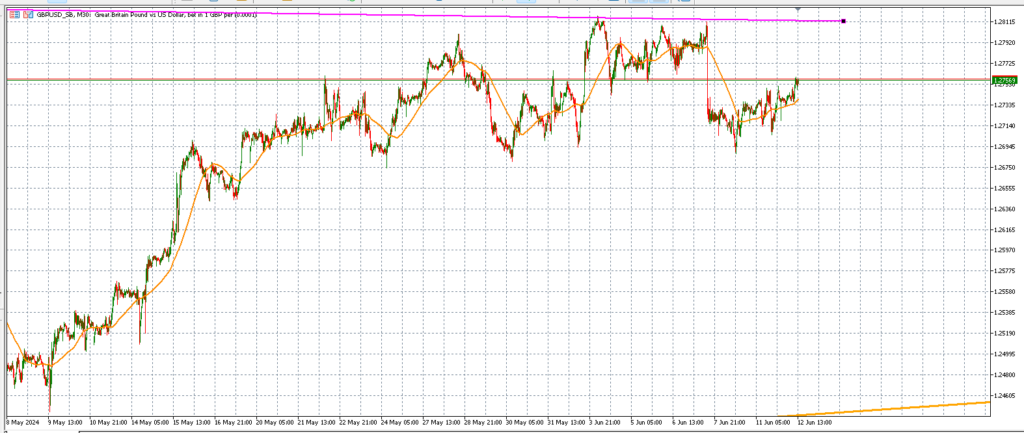

Best CFD Forex Brokers: GBPUSD chart by CompareBroker