Arkansas Economic Development Commission executive director Clint O’Neal says the push to lower Arkansas’ top personal income tax rate below four percent as well as drop the corporate income tax rate will open the door for more business to come to the state.

Gov. Sarah Sanders is calling the Arkansas General Assembly into session Monday (June 17) to cut personal income tax rates from 4.4% to 3.9%, corporate tax rates from 4.8% to 4.3%, and to expand the homestead tax credit by another $75 to $500 for homeowners.

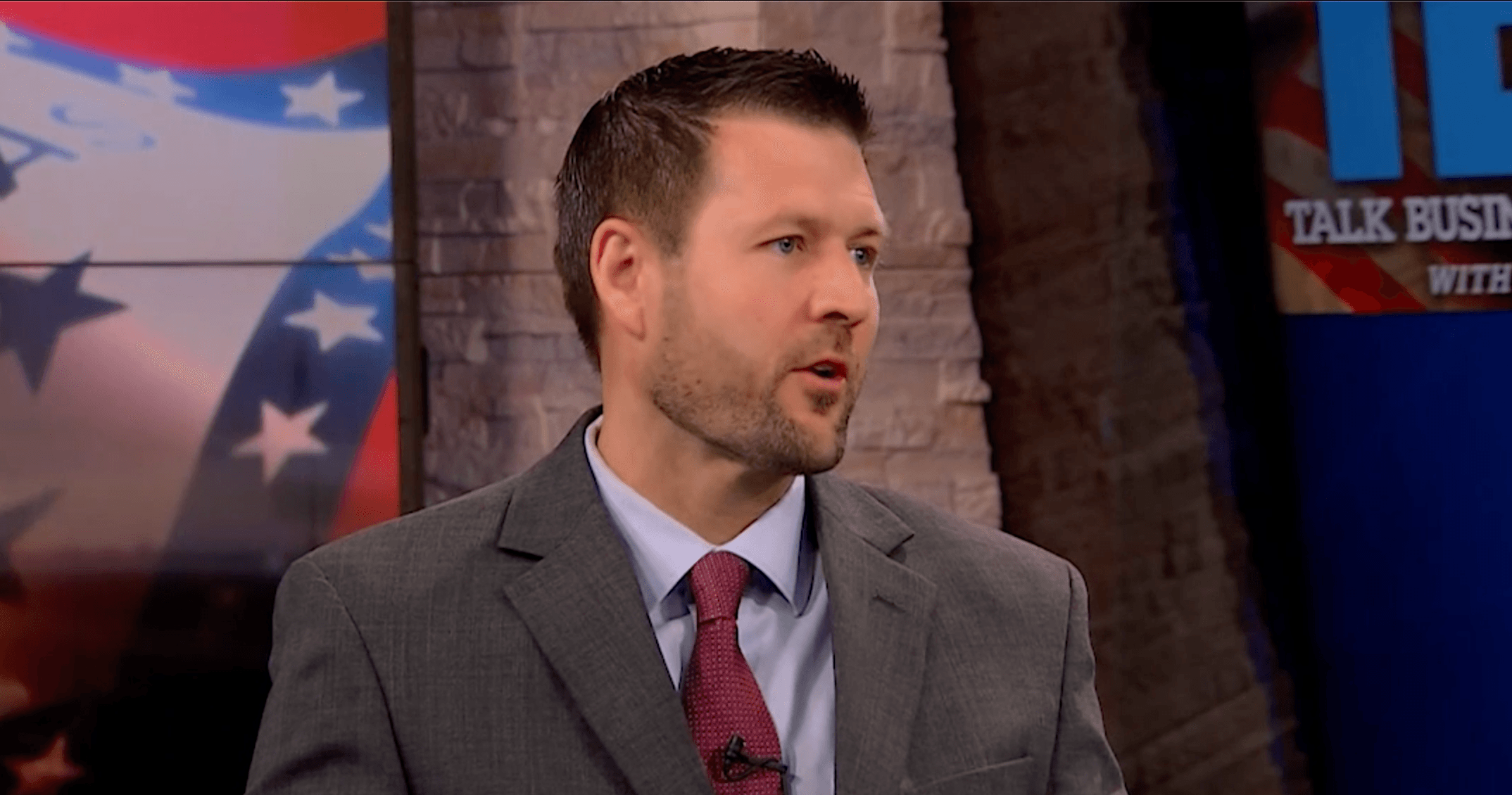

Appearing on this week’s edition of Talk Business & Politics, O’Neal said the tax cuts expected to be enacted this week in a legislative special session is psychological and tangible.

“It’s significant to us. It’s our message to all of our Arkansas business owners, business executives that are looking to Arkansas for a good place to do business that regardless of any incentive package, this benefits everyone,” he said.

“I think there is something big about going below four percent. And just the story that Gov. Sanders has cut taxes twice, coming back for a third time. If you look back even further over the last 10 years of going from where we were at 7% to now less than 4% on the individual side, down another half percentage point on the corporate side, it’s sending a message that other states are not sending. Other states are sending this message that we’re having a tough time balancing our budget. The only way to make that up is to raise taxes. Our message is that we’re getting ready to lower taxes because we’ve been fiscally responsible,” O’Neal said.

The tax cuts have come over the past 10 years and will be boosted by the fact that Arkansas is expected to end its fiscal year on June 30 with a surplus of over $708 million. Sanders and lawmakers are planning to put $290 million in a restricted reserve fund.

Business Developments and Economic Impact

O’Neal said that there is a large pipeline of projects being considered for development in Arkansas and across the U.S. The Presidential election cycle may delay some of those projects, but there are plenty of site visits and expansion plans being considered.

“I think it’s at an all-time high,” he said. “It’s a presidential election year, which typically puts some large capital investment projects on hold. We’re seeing a lot of things kind of stuck in the pipeline, really eager for some good jobs announcements. We’ll definitely have some in the coming months, so stay tuned for that.”

O’Neal discussed some recent successes and setbacks in the interview:

- On Windsor Door, which announced a $21 million production line expansion this week: “It’s a sign of confidence that the workforce here in Arkansas is getting the job done for ’em. That the business climate facilitates growth.

- On Westrock Coffee, which opened its $315 million Conway facility early: “Such an inspirational story, how it helps Arkansans with jobs, a great consumer product and they are helping coffee growers around the world.”

- On Hino Motors, which announced it would close its Marion facility and layoff 1,300 workers: “We’re very engaged with the local leadership team in Marion as well as the government affairs team with Hino. They report right now that they’ll be in operation until mid to late 2027. So there’s not a lot that we can do now, but you certainly begin to lay the groundwork, as we have for others, unfortunately in the last year that have announced layoffs.”

You can watch O’Neal’s full interview in the video below where he also talks about a new site development program that further prepares communities for economic development projects.

[embedded content]