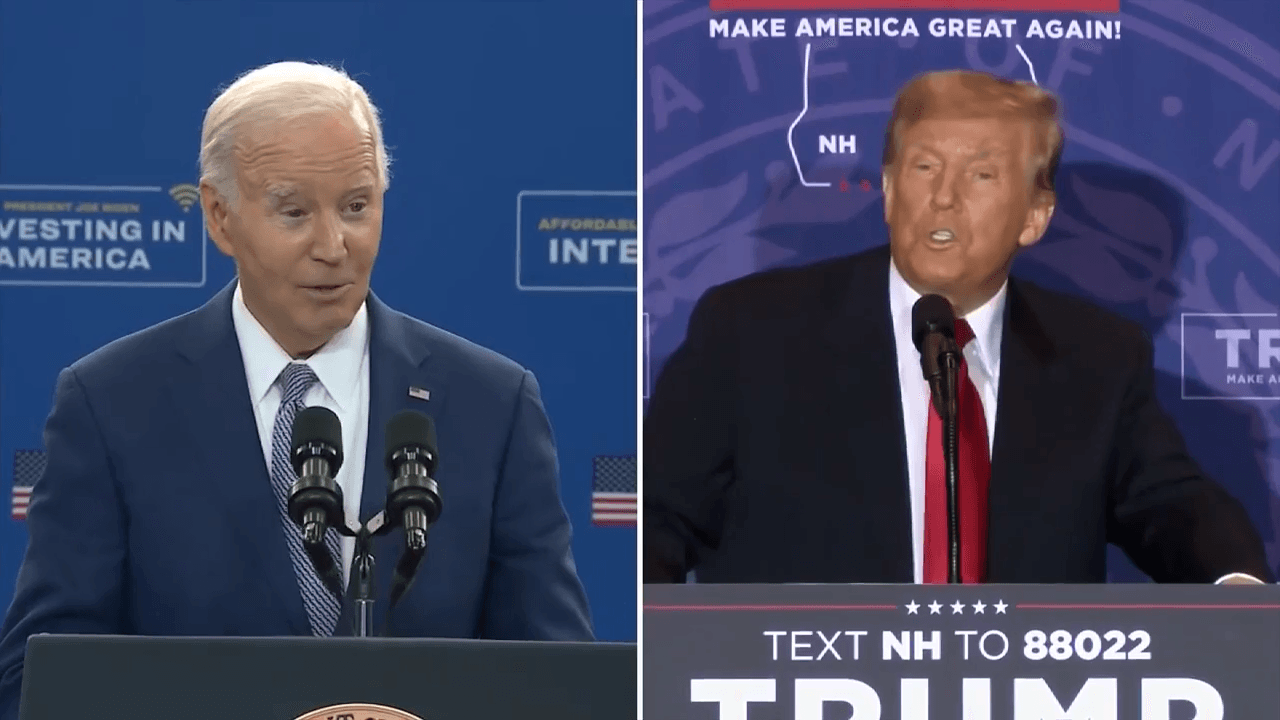

In a closed-door meeting with the Business Roundtable, former President Donald Trump and President Joe Biden’s chief of staff, Jeffrey Zients, presented starkly different visions for the future of corporate taxes and economic policy. Trump, eyeing a potential 2024 rematch, emphasized further cuts to the corporate tax rate, while Zients underscored the importance of global alliances and stable institutions for business growth.

Trump’s Tax Cut Proposal

According to a source familiar with the meeting, Trump proposed reducing the corporate tax rate by an additional percentage point to 20%. This move would build on the 2017 tax cuts he signed into law, which are set to expire after 2025. Trump’s focus was on taxes, inflation, and increasing oil production. The Business Roundtable, representing over 200 CEOs, has made preserving these tax cuts its top legislative priority, planning to spend at least $10 million on a campaign to maintain the corporate tax rate at 21%.

Business leaders argue that lower taxes enhance their global competitiveness, allowing them to hire more workers and invest in new technologies. Jon Moeller, CEO and board chairman of Procter & Gamble, warned that higher corporate taxes would likely be passed on to consumers through increased prices and could limit wage growth for employees.

Zients’ Emphasis on Global Alliances

On the other hand, Zients highlighted the Biden administration’s commitment to global alliances and independent institutions like the Federal Reserve. He argued that these elements foster trust worldwide, enabling U.S. capitalism to thrive. Zients pointed out that the post-pandemic economic recovery was partly due to the administration’s collaboration with businesses on issues such as supply chains. He also cautioned that Trump’s policies on deportation and potential trade wars could drive up inflation.

Biden’s budget proposal aims to raise corporate taxes by nearly $2.2 trillion over ten years, with more than half of that revenue coming from resetting the corporate tax rate at 28%. This is still lower than the 35% rate before Trump’s 2017 cuts. The Biden administration maintains that any tax cuts should be paid for as part of a comprehensive proposal, contrasting with the 2017 overhaul that led to higher budget deficits.

Recent economic research suggests that while Trump’s corporate tax cuts did boost business investment, they did not generate enough growth to cover their cost. The Congressional Budget Office estimates that extending these expiring tax cuts would cost $4.9 trillion over ten years, including additional interest on the debt.

As both parties prepare for a potential showdown over the tax code, business leaders continue to advocate for lower taxes as a means to drive growth and competitiveness. The debate underscores the broader ideological divide between Trump’s vision of lower taxes and deregulation and Biden’s focus on global cooperation and fiscal responsibility.