New Jersey has reached a tentative agreement with the state’s most profitable companies to temporarily pay higher taxes to fund NJ Transit. Under the plan, the 600 corporations in the state that make at least $10 million a year in profits will pay a 2.5% tax on all earnings for five years. In return, the state will not pursue restoring the sales tax to 7% from 6.625%, a major point of contention for the businesses, who strongly oppose increasing the corporate tax rate.

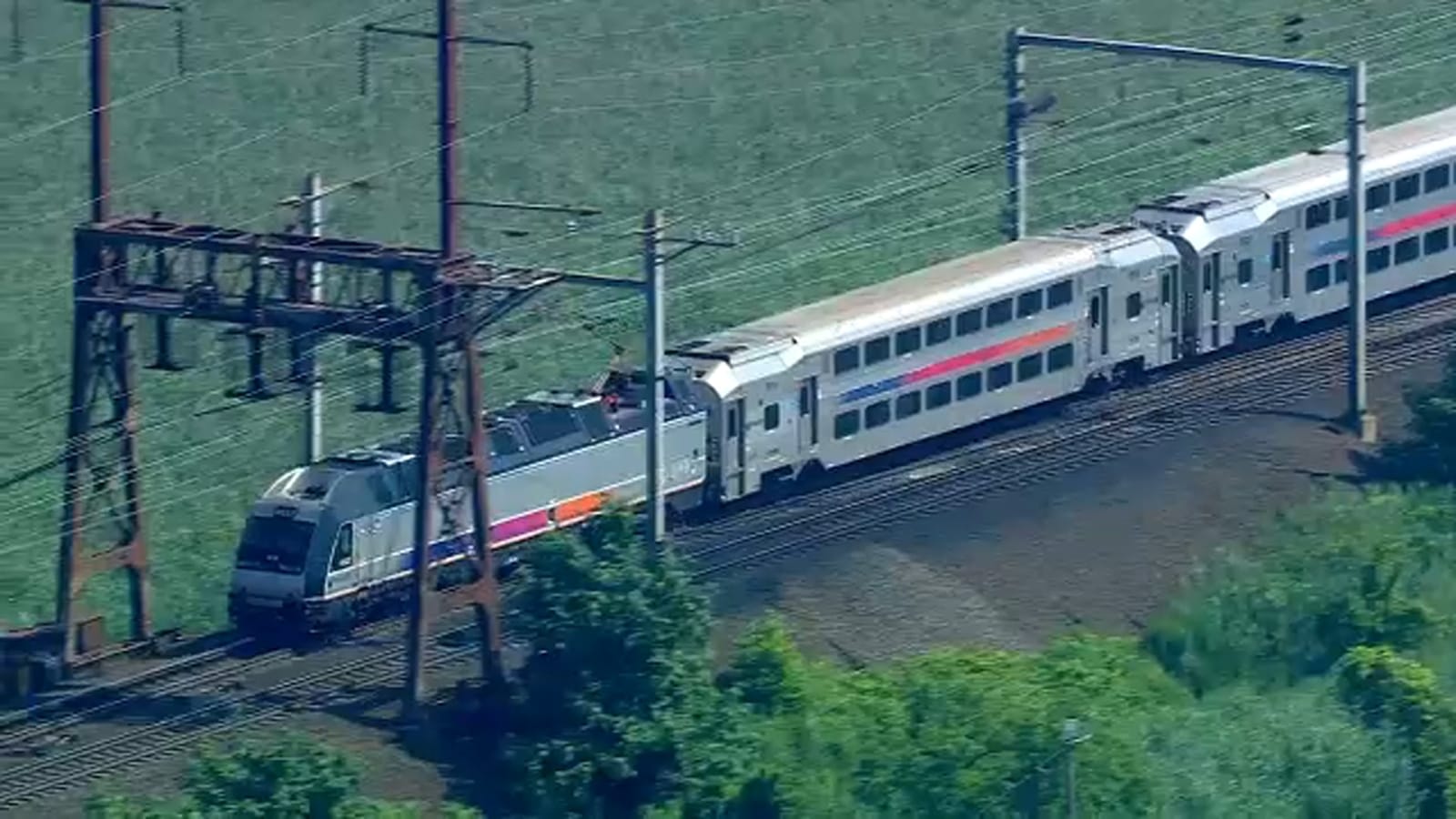

Both the “transit tax” and a final state budget still need to be approved by the Legislature next week. The budget expires June 30. The potential deal comes amid a “nightmare” week for NJ Transit and Amtrak, which saw a string of service disruptions adversely impact rail commuters.

Understanding Lease Agreements

In the world of business, understanding what is a lease can be crucial for both companies and individuals. A lease is a contractual arrangement where one party, known as the lessor, grants another party, known as the lessee, the right to use an asset for a specified period in exchange for periodic payments. The lease definition encompasses various types of leases, including property, equipment, and vehicle leases.

The lease meaning goes beyond just the use of an asset; it involves responsibilities and obligations for both parties. For instance, the lessee must maintain the asset in good condition and make timely payments, while the lessor must ensure that the asset is fit for use.

Lease agreements are pivotal in business operations, allowing companies to use assets without committing significant capital upfront. This flexibility can be especially beneficial for startups and small businesses looking to manage their cash flow effectively.

NJ Transit and CEO Kevin Corbett released a statement Friday afternoon, calling the recent service issues “unacceptable.” “We are as frustrated as our customers, and the frequency and impact these issues are having on our customers’ quality of life is clearly unacceptable. Regarding today’s incident specifically, we’ve had rail maintenance supervisors positioned at Newark Penn Station to inspect trains in light of the recent incidents. The train involved was inspected thoroughly before leaving Newark, including the pantograph, and no defects were found,” Corbett said.

Corbett went on to say that they are working with Amtrak to identify root causes of the recent spate of incidents.