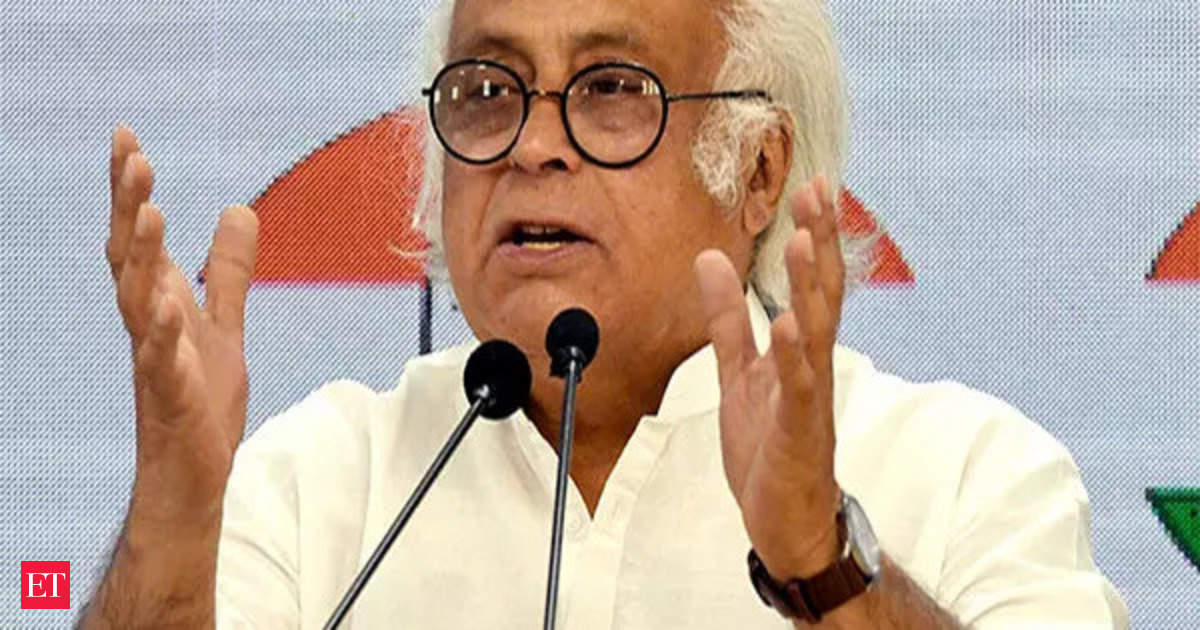

Congress leader Jairam Ramesh has recently taken to social media platform X to critique the Bharatiya Janata Party-led Centre over the latest tax collection data. According to Ramesh, individuals are shouldering a heavier tax burden compared to corporations, with the middle class feeling the brunt of heavy taxation. He pointed out that Rs 2 lakh crore has been funneled into the “pockets of billionaires” due to reductions in corporate taxes.

Tax Collection Data: A Closer Look

Ramesh highlighted that from April 1 to July 1, 2024, income tax collections stood at Rs 3.61 lakh crores, while gross corporate tax collections were Rs 2.65 lakh crores. This data, he argues, reaffirms the point that individuals are paying more tax than companies. The Congress general secretary further noted that during former Prime Minister Manmohan Singh’s tenure, personal income tax accounted for 21% of total tax collections, a figure that has now risen to 28%. Conversely, corporate tax on companies has fallen from 35% to 26%.

“When Dr. Manmohan Singh left office, personal income tax was 21% of total tax collections, while corporate tax was 35%. Today, the share of corporate taxes out of total tax collection has dropped sharply to its lowest level in a decade, at just 26%. Meanwhile, the share of personal income tax in total tax collection has shot up to 28%,” Ramesh stated.

Impact of Corporate Tax Cuts

Ramesh also criticized the Centre’s 2019 decision to reduce corporate tax rates, arguing that it did not spur the anticipated private investment boom. Instead, private investment has declined from 35% under UPA rule to under 29% today. “Corporate tax rates were slashed on 20 Sept 2019 in the hope that it would trigger a private investment boom. But that has NOT happened. Instead, private investment has collapsed, from a peak of 35% of GDP under Dr. Manmohan Singh, to below 29% during 2014-24,” he stated.

The Congress leader’s comments have sparked a debate on the efficacy of tax policies and their impact on different economic classes. As the nation heads towards the Budget on July 23rd, these discussions are likely to intensify, shedding light on the broader implications of fiscal decisions made by the government.