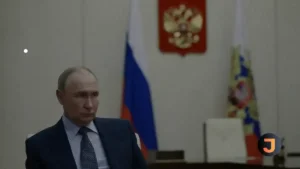

Russian President Vladimir Putin has signed a bill that raises income taxes for the wealthy, part of efforts to help fill government coffers depleted by the war in Ukraine. The tax hikes are being presented domestically as “systemic reforms.”

Systemic Reforms and Fiscal Strategy

On Friday, Putin approved a package of tax increases worth nearly $30 billion, targeting both workers and companies to contribute funds for his Ukraine offensive. Moscow’s spending has outpaced revenue by tens of billions of dollars since it ordered troops into Ukraine in February 2022. This has helped the economy defy expectations of a deep recession but has also pushed it into rare budget deficits.

In 2023, Russia ran a budget deficit of around 3.2 trillion rubles ($36 billion), equivalent to two percent of GDP. The new amendments to Russia’s tax code include increases on income taxes for high earners and corporate taxes paid by businesses, aiming to plug the fiscal hole. These amendments were passed by Russia’s rubber-stamp parliament earlier this week.

“The changes are aimed at building a fair and balanced tax system,” Finance Minister Anton Siluanov said when the proposed changes were laid out in May. He added that the extra funds would bolster Russia’s “economic well-being” and go towards a series of public investment projects.

The tax hikes, which are being presented domestically as “systemic reforms,” will raise around 2.6 trillion rubles ($29 billion) in 2025 when they come into force, according to finance ministry estimates. Russia has budgeted for a 1.1-percent shortfall this year—modest compared to many countries.

Economic Implications and Military Spending

With Russia locked out from Western financial markets and around $300 billion of its foreign currency reserves frozen by sanctions, Moscow’s public finances are a key indicator of how long and how aggressively the Kremlin can fund its military campaign in Ukraine. Over the last two years, Russia has dipped into its sovereign wealth fund and borrowed from state-owned banks to cover the deficit.

Spending on defense and security has ballooned to more than eight percent of Russia’s GDP, Putin said in May. He called the state’s military budget a “great resource” that should be used “carefully and effectively.” Moscow offers its soldiers fighting in Ukraine huge salaries and benefits and has also pumped resources into domestic weapons’ manufacturers as its offensive in Ukraine drags into its third year and looks locked in a state of attrition.