Patent box regimes, also known as intellectual property (IP) regimes, are designed to tax business income earned from IP at rates below the statutory corporate income tax rate. The primary goal is to foster local research and development (R&D) by providing financial incentives for businesses to locate their IP within a country. These regimes typically cover patents and software copyrights, with income derived from IP including royalties, licensing fees, gains on the sale of IP, sales of goods and services incorporating IP, and patent infringement damage awards.

Widespread Adoption Across Europe

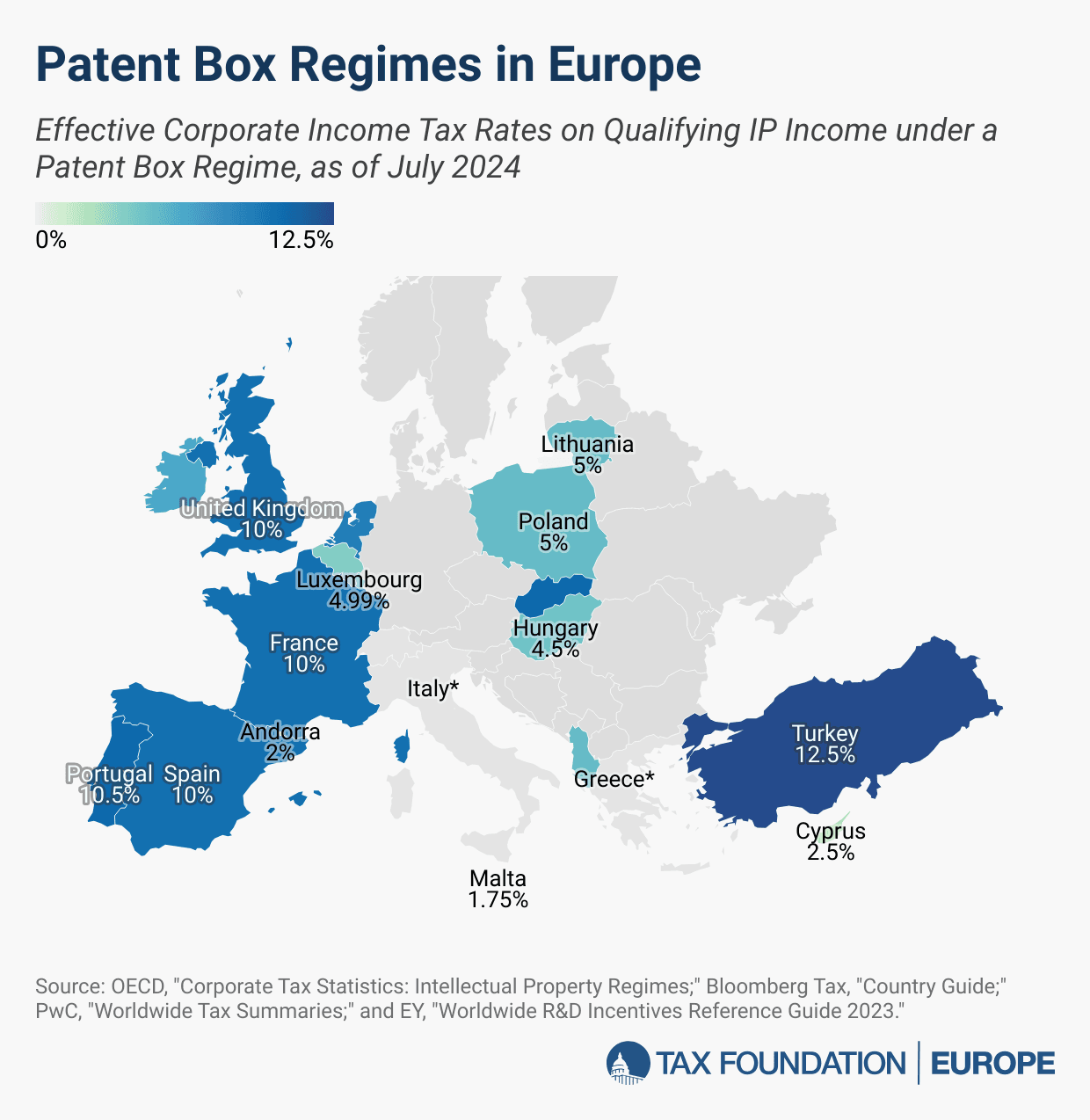

Patent box regimes have become increasingly common in Europe over the past two decades. Currently, 13 of the 27 EU Member States have implemented such regimes. These countries include Belgium, Cyprus, France, Hungary, Ireland, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Slovakia, and Spain. Additionally, non-EU countries like Albania, Serbia, Switzerland, Turkey, and the United Kingdom have also adopted patent box regimes.

The reduced tax rates under these regimes vary significantly. For instance, Malta offers a rate as low as 1.75 percent, while Turkey’s rate stands at 12.5 percent. In comparison, the United States applies a preferential tax rate of 13.125 percent on foreign-derived intangible income (FDII), which is set to increase to 16.4 percent in 2025.

Recent Reforms and Repeals

In recent years, several European countries have repealed their patent boxes due to concerns about profit shifting and the effectiveness of these regimes in driving innovation. Andorra phased out its patent box between 2018 and 2020, while Italy replaced its patent box with a super-deduction for R&D costs in 2021. San Marino followed suit in 2022 by repealing both of its IP regimes. Conversely, Portugal increased its corporate income tax exemption for patent income from 50 to 85 percent in 2022.

OECD’s Modified Nexus Approach

In 2015, OECD countries agreed on a Modified Nexus Approach for IP regimes as part of Action 5 of the OECD’s Base Erosion and Profit Shifting (BEPS) Action Plan. This approach limits the scope of qualifying IP assets and requires a geographic link among R&D expenditures, IP assets, and IP income. As a result, many countries have either abolished or amended their patent box regimes to comply with this approach.

In addition to patent box regimes, many European countries offer other R&D incentives such as direct government support, R&D tax credits, or accelerated depreciation on R&D assets. These measures can further reduce the effective tax rates on IP income beyond the rates stated in the respective patent box regimes.