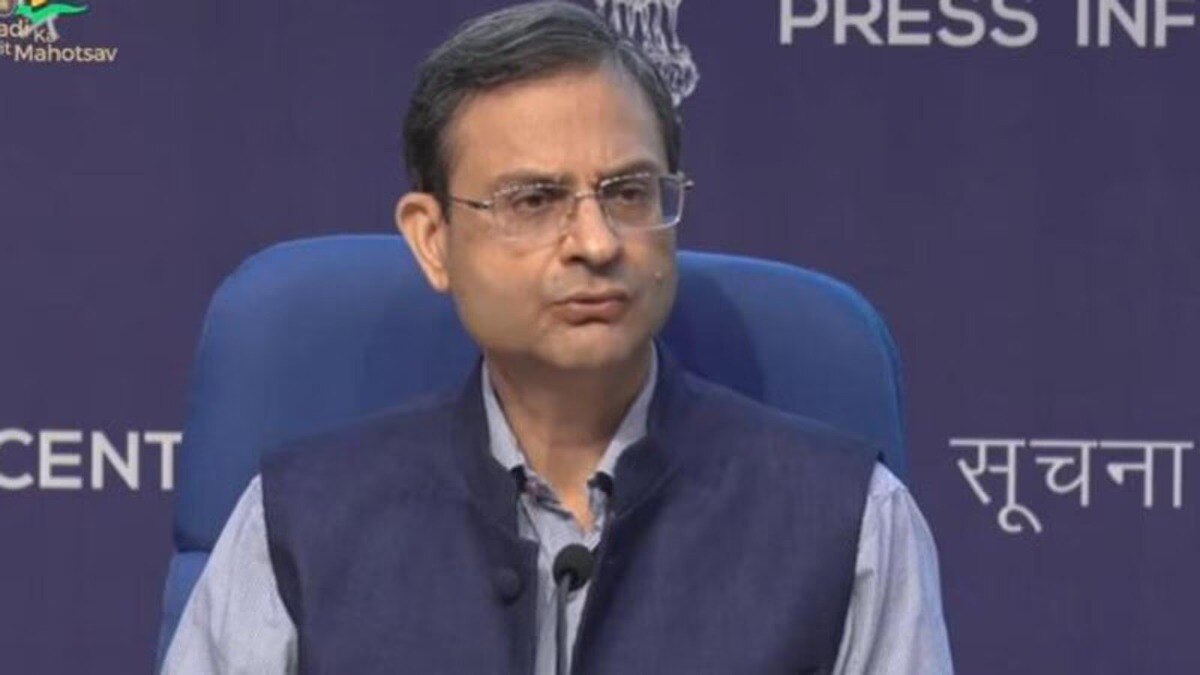

Revenue Secretary Sanjay Malhotra attributed improved compliance as well as the progressive income tax rates as the two main reasons why personal income tax collections have exceeded those of corporate income tax in recent years. “While there are four reasons as such for this trend, the two major reasons are improving compliance and the progressive rates of income tax,” the revenue secretary told BT in an interview.

While tax compliance and efficiencies have improved, there are also taxes such as those on dividends that are now levied on the shareholder rather than in the hands of the company, he noted. He also pointed out that corporate tax rates have been cut, which is another reason for the higher collections from personal income tax.

In September 2019, the government had lowered the base rate for corporate tax to 22% from the earlier rate of 30%. In the Union Budget 2024-25, the tax rate for foreign companies has also been lowered to 35% from 40%.

“Fourth, and according to me, most importantly, it is also because income levels of people are moving up. So because the tax rates are progressive, I think this is the single [biggest] reason why personal income taxes are growing faster than corporate taxes,” he said, noting that an increase of 10% of corporate income will yield a 10% increase in corporate tax but an increase of 10% personal income can lead to an increase of more than 10% in the personal income tax.

“The tax rate and the slab increases as the income increases,” he pointed out, adding that this trend is likely to sustain as personal income tax rates will remain progressive in nature.

In a marginal relief to taxpayers, the Budget also re-jigged the income tax rate under the new income tax regime. The highest tax rate is set at 30% for those earning Rs 15 lakh or more under the new income tax regime while it is at 30% for those earning Rs 10 lakh or more in the old regime. A surcharge at progressive rates is also levied on annual income of above Rs 50 lakh or more ranging from 10% to 37%.

Lease and Taxation: A Closer Look

Understanding what is a lease and its implications can be crucial for businesses navigating these tax changes. The lease definition typically involves a contractual agreement where one party (the lessor) allows another party (the lessee) to use an asset for a specified period in exchange for periodic payments. The lease meaning extends beyond just real estate; it can include equipment, vehicles, and other assets.

In FY23, the taxes on income yielded Rs 8.33 lakh crore while corporate tax revenue amounted to Rs 8.25 lakh crore. Similarly, in FY24, the taxes on income brought in Rs 10.44 lakh crore while the corporate tax mop-up was Rs 9.11 lakh crore. According to the Budget Estimates for FY25, the target from personal income tax is set at Rs 11.87 lakh crore while the target from corporate tax is pegged at Rs 10.2 lakh crore.

Till July 11 this year, gross personal income tax collections amounted to Rs 3.61 lakh crore (excluding STT and other taxes), while the gross mop-up from corporate tax was Rs 2.65 lakh crore.