Capital allowances play a significant role in shaping a country’s corporate tax base, influencing investment decisions with broad economic implications. The extent to which businesses can deduct their capital investments varies widely across European nations.

Understanding Capital Allowances

Businesses calculate their profits by subtracting costs such as wages, raw materials, and equipment from revenue. However, capital investments are typically not treated as regular costs that can be deducted in the year of acquisition. Instead, depreciation schedules determine the life span of an asset, dictating the number of years over which an asset must be written off. By the end of this period, the business would have deducted the total initial cost of the asset.

Most depreciation schedules do not account for the time value of money, which includes a normal return plus inflation. For example, if a machine costs €10,000 and has a life span of 10 years, a business could deduct €1,000 annually. However, due to the time value of money, a deduction of €1,000 in later years is less valuable in real terms than today’s deduction. This inflates taxable profits and increases the cost of capital investment, potentially leading to reduced business investment and lower productivity.

European Landscape

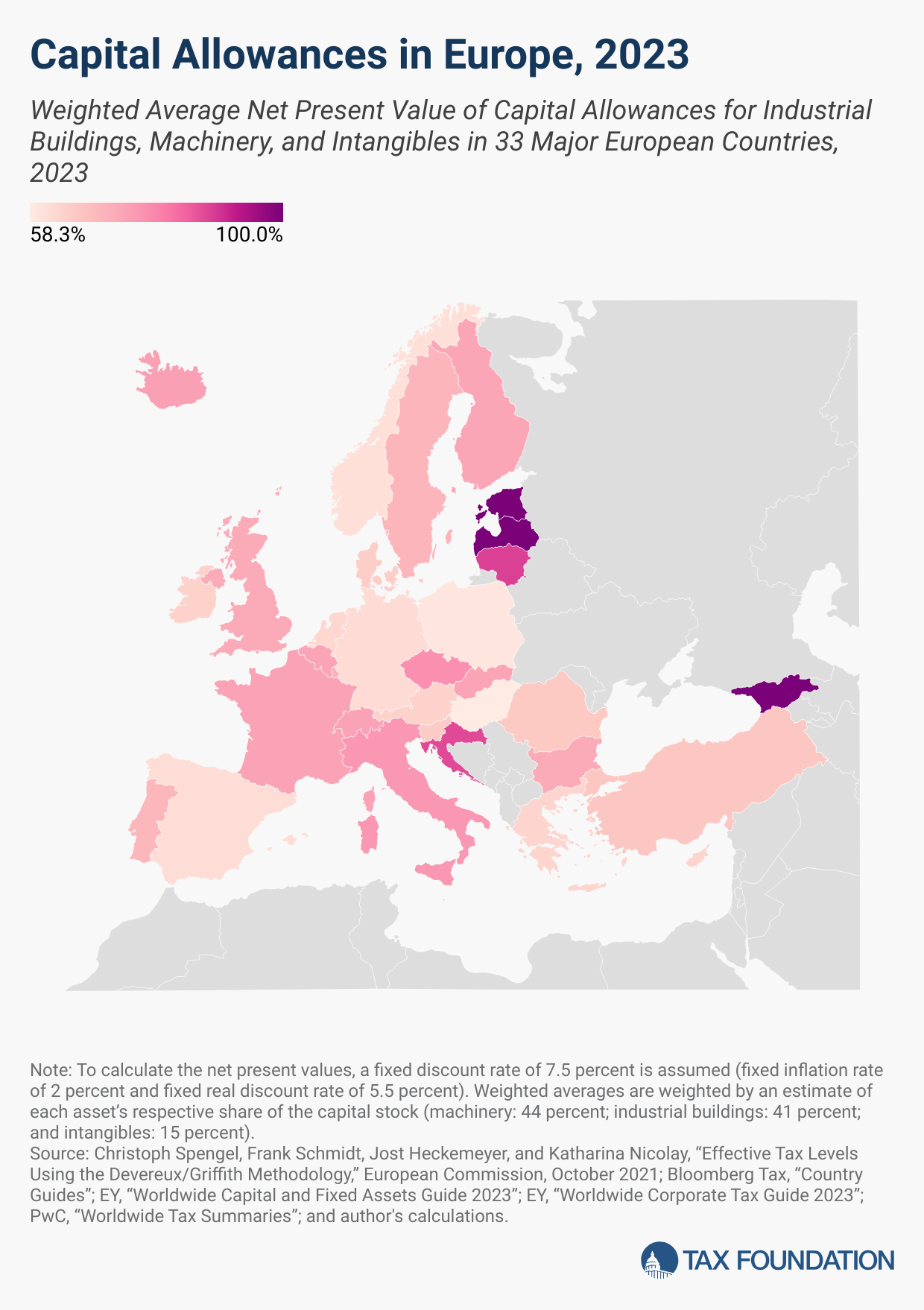

The map reflects the weighted average capital allowances for three asset types: machinery, industrial buildings, and intangibles (patents and “know-how”). Capital allowances are expressed as a percentage of the present value cost that businesses can write off over an asset’s life. Estonia, Georgia, and Latvia allow businesses to deduct 100 percent of the present value of all capital investments, making their treatment of capital investment the most attractive in Europe.

Among countries without distribution-based systems, Lithuania (88.2 percent), Croatia (87.2 percent), and the Czech Republic (77.6 percent) offered the best tax treatment of capital investment in 2023. Conversely, businesses in Norway (60.7 percent), Poland (59.3 percent), and Hungary (58.3 percent) could write off the lowest shares of their investment costs.

On average, in 2023, European businesses could write off 71.9 percent of the present value cost of their investments in machinery, industrial buildings, and intangibles. By asset category, machinery had the highest capital allowances (86.9 percent), followed by intangibles (82.6 percent) and industrial buildings (52.1 percent).

Comparative Analysis

In 2023, the US allowed its businesses to recover 66.7 percent of capital investment costs on average. However, bonus depreciation adopted in 2017 is phasing out in 2023, returning to a less generous policy by 2027.

Countries like Finland, Germany, and the United Kingdom have recognized the importance of capital allowances in supporting business investment and have extended or modified expiring policies. For instance, Finland temporarily doubled its declining-balance depreciation rate for machinery from 2020-2023 and recently extended it to 2025.

Germany renewed its accelerated depreciation schedules for machinery partly in 2024 and plans to extend them into 2028. The United Kingdom implemented full expensing for machinery and equipment in April 2023 and made it a permanent feature of the tax code in the 2023 Autumn Statement.

As European countries strive to support investment, policymakers should aim to provide immediate deductions for investments in machinery and equipment permanently and adjust for inflation and the time value of money for all other capital investments.