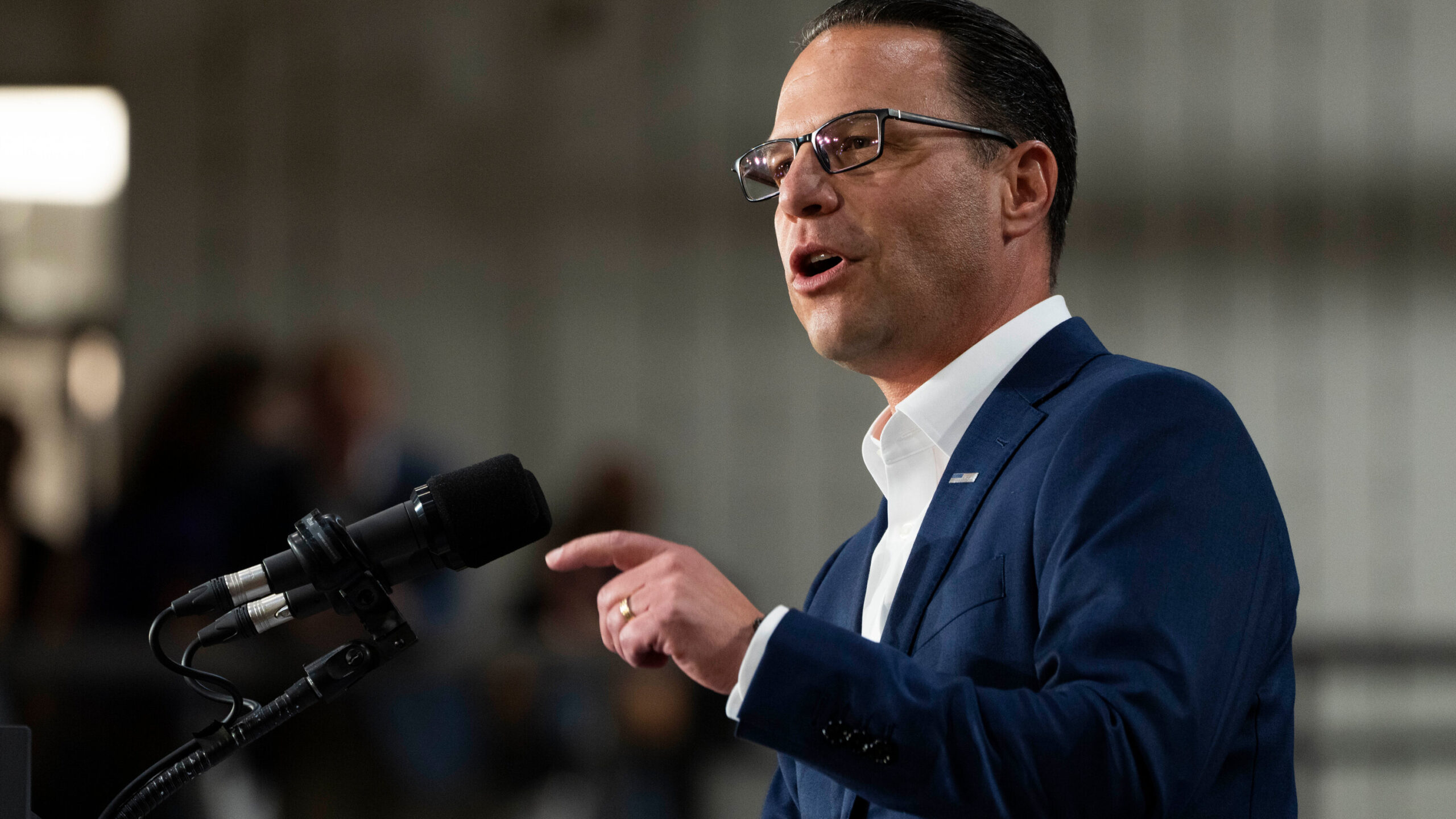

Gov. Josh Shapiro of Pennsylvania, who is one of several Democrats in consideration to become Vice President Kamala Harris’s running mate, expressed on Tuesday his opposition to the proposed takeover of U.S. Steel by Japan’s Nippon Steel, citing his reservations about its potential impact on workers in his state. Mr. Shapiro’s comments came during an event with Treasury Secretary Janet L. Yellen in Philadelphia.

The proposed acquisition of U.S. Steel has become a sensitive political matter this year, with many Democrats, including Senator John Fetterman of Pennsylvania, calling on President Biden to block the deal. Mr. Biden has said that the company should remain “domestically owned and operated.” The merger is expected to be reviewed by the Committee on Foreign Investment in the United States, which is headed by Ms. Yellen.

“I have serious concerns about the deal that has been put forth,” Mr. Shapiro said, adding that he was considering what the potential takeover would mean for Pennsylvania as a national manufacturing hub. “Speaking from a state perspective, as governor, if the U.S. Steel workers aren’t happy with this deal, which they are not, I’m not happy with this deal.”

The Biden administration has been reviewing the nearly $15 billion buyout and could block it with the argument that it poses a threat to national security. Yet some international deals experts have suggested that such a move would seem overtly political since Japan is a strong U.S. ally. Former President Donald J. Trump and his running mate, Senator JD Vance, have also spoken against the acquisition of U.S. Steel.

Ms. Yellen said that she could not discuss the details of the deal. “We would look at any transaction from the national security perspective, and try to make a reasoned judgment,” she said.

Lease and Economic Policies

In addition to his criticism of the deal, Mr. Shapiro offered a strong endorsement of the impact that the Biden administration’s economic agenda has had on the state. The governor also defended his efforts to cut corporate taxes in Pennsylvania, which clashes with Mr. Biden and Ms. Harris’s aim to raise taxes on companies. He said that reducing taxes on businesses was part of a strategy to recruit companies from other states to Pennsylvania.

“That’s why I’ve been so aggressively working to cut business taxes and make sure that we have an environment here that works for business owners,” Mr. Shapiro said.

Understanding lease meaning and lease definition is crucial for businesses considering relocation or expansion. A lease is a contractual agreement where one party (the lessor) grants another party (the lessee) the right to use an asset for a specified period in exchange for periodic payments. What is a lease? It’s essentially a way for businesses to manage their resources efficiently without committing large amounts of capital upfront.

With Pennsylvania’s favorable tax policies, businesses might find leasing properties or equipment more attractive, thereby boosting local economic growth and job creation.