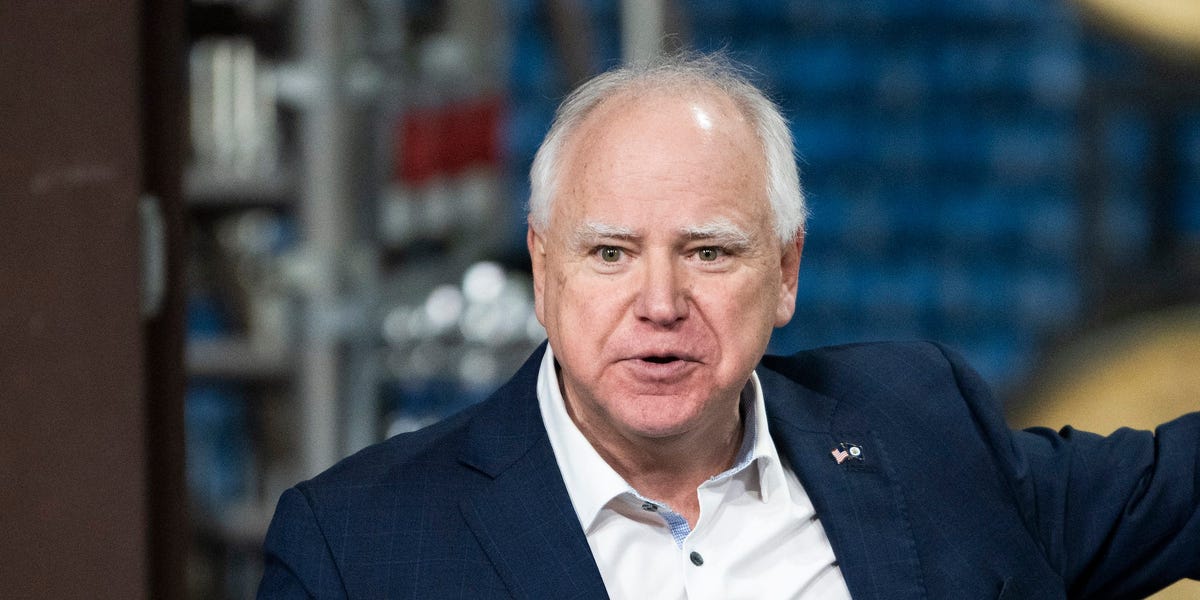

Governor Tim Walz of Minnesota has been a prominent figure in progressive economic policies, and his record speaks volumes about his goals for the state’s future. His initiatives span various sectors, from education to labor protections and clean energy, reflecting a comprehensive approach to economic development.

Universal Free School Meals

In March 2023, Walz signed into law a bill providing universal free school lunches, ensuring that every student receives a free breakfast and lunch daily, regardless of income. This initiative filled the funding gap left by the National School Lunch Program and simplified the process for parents and administrators. The program, costing nearly $300 million annually, led to a 30% increase in breakfasts and an 11% rise in lunches served between September 2022 and September 2023.

Job Creation

Walz’s Local Jobs and Projects Plan allocated $1.9 billion for construction and renovation projects, with over a third dedicated to asset preservation. This included repairing university buildings and improving infrastructure. Additionally, more than $450 million was directed towards affordable housing projects. The Governor’s Council on Economic Expansion was also established, involving 15 business leaders to foster economic growth.

Tax Cuts and Rebates

The One Minnesota Budget introduced state tax cuts benefiting nearly 1.4 million middle-class Minnesotans and increased funding for public education. The administration also provided tax rebates, known as “Walz checks,” which amounted to $1,300 in some cases. However, starting in 2024, these rebates became taxable by the IRS.

Cannabis Legalization

In May 2023, Walz legalized cannabis use for adults, establishing the Office of Cannabis Management to regulate the industry. This move aimed to expand the economy, create jobs, and ensure safety within the sector. Minnesota became the 23rd state to legalize cannabis use.

Increased Labor Protections

Walz’s administration expanded worker protections in 2023, including sick time accrual for every 30 hours worked and implementing paid family and medical leave by 2026. The laws also enhanced the Women’s Economic Security Act, providing accommodations for pregnant employees and new parents. Safety provisions were strengthened for workers in various industries, and non-compete agreements were banned.

Clean Energy and the Environment

Walz signed legislation requiring Minnesota to generate 100% of its electricity from carbon-free sources by 2040. The Governor’s Biofuels Council was created to facilitate the transition to clean energy. Over 40 climate initiatives were passed, including improving electric vehicle charging infrastructure and building energy-efficient housing. Minnesota also became the second state to phase out nonessential PFAS chemicals.

Education and Support for Parents

Walz has significantly increased funding for K-12 schools by over $2.2 billion. The state now offers free college tuition for low-income families earning less than $80,000 annually, benefiting between 15,000 and 20,000 students. The budget also expanded eligibility for student grants and increased funding for Indigenous students and universities. Additionally, the state’s child tax credit has supported over 215,000 families this year.