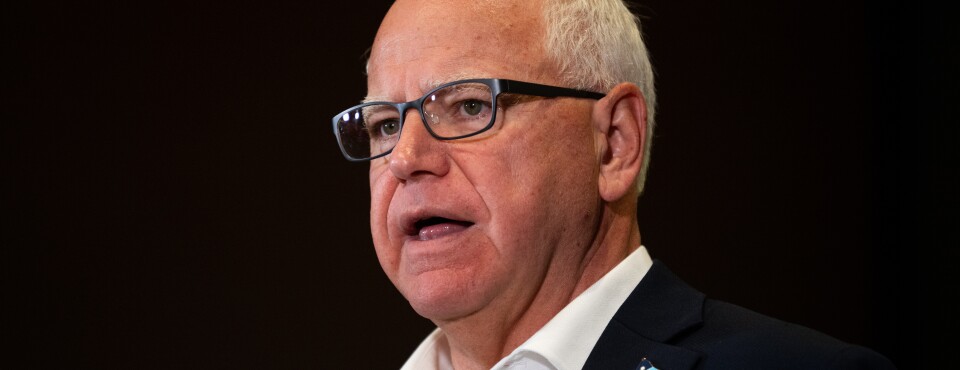

Minnesota Gov. Tim Walz isn’t generally regarded as a tax policy guy, but tax analysts and lawmakers say Vice President Kamala Harris’s new running mate has supervised the most dramatic shift toward progressive tax policy of any state in the country. While more than two dozen governors slashed individual and corporate taxes during the post-Covid period, Walz enacted sweeping reforms that raised taxes on businesses and wealthy individuals to pay for an expanded state social safety net and a menu of tax benefits aimed at low-income taxpayers and working families.

Based on past performance—particularly under Walz’s “One Minnesota” biennial budget—the second-term Democrat is the most progressive governor Harris could have chosen as her running mate, said Jared Walczak, vice president of state projects at the right-leaning Tax Foundation. “He’s presided over multiple tax increases in an era when very few states have any significant tax increases,” Walczak said. “Minnesota is an outlier state with high taxes that are getting higher, and Walz is also an outlier among the others considered. Josh Shapiro has talked about tax competitiveness. Andy Beshear has maintained a stay-the-course approach, along with some tax reductions.”

The progressive Institute for Tax and Economic Policy characterized Walz’s approach as “far from radical.” “The state has embraced practical, administrable reforms that have lowered taxes for working-class families, reduced child poverty, and addressed the public’s frustrations with the tax treatment of multinational companies and wealthy people,” wrote research director Carl Davis shortly after Harris announced her selection.

Historic Tax Reforms

With Democratic majorities in both the House and the Senate starting in 2023, Walz worked with the Legislature on a 2024-25 budget that collects additional revenue through conformity with the federal approach to taxing the global intangible low-taxed income, or GILTI, of multinational corporations—an anti-base erosion feature of the 2017 federal tax law. High-income taxpayers were asked to pay more to the state under a less generous scheme for claiming standardized and itemized deductions. The budget also included a new 1% tax on net investment income over $1 million.

Minnesota sent rebates to 2.4 million taxpayers under a one-time refundable tax credit program in 2023. Senior citizens benefited from provisions shielding certain pension and Social Security income from taxes. Perhaps Walz’s biggest tax achievement as governor is a $1,750 refundable child tax credit, with no limit on the number of children claimed. The program was amended earlier this year to make Minnesota the first state to offer an advanced payment option, giving eligible parents the flexibility to receive the money prior to filing their returns.

During the budget process, Walz demonstrated less interest in the intricacies of the state tax code than the tools it offered to achieve his social priorities, legislative leaders said. “He’s not a tax dude inherently, but he doesn’t shy away from the discussion that in order to have a society that functions for everybody—things like paid family medical leave, universal school meals, infrastructure—you have to pay for this stuff,” said House Taxes Committee Chair Rep. Aisha Gomez (D).

Sen. Ann Rest (D), chair of the Senate Taxes Committee, described Walz as a “practical progressive” in the model of two previous Minnesotans who served as vice president—Hubert Humphrey and Walter Mondale. “He’s not a CPA, he’s not an attorney, but he knows tax policy can be used to benefit middle-income folks and their families and bring children out of poverty,” she said.