In the dynamic landscape of global finance, tax systems are not merely fiscal instruments but are pivotal in sculpting the architecture of modern economies. At the heart of this intricate structure lies the corporate tax regime, a subject of enduring debate and scrutiny. The corporate tax system in Spain, reflecting broader global patterns, stands at a crossroads, shaped by decades of policy reforms and economic shifts. The primary purpose of this research is to offer a comprehensive analysis of Spain’s corporate tax system to evaluate its efficiency in generating revenue and its impact on economic activities and investment. This study emerges from a compelling observation: the potential exhaustion of the corporate tax system’s revenue-generating capacity, a phenomenon that could have profound implications for Spain’s fiscal policy and economic vitality.

Spain’s Corporate Tax System and Its Historical Context

Spain’s corporate tax system has undergone significant transformations over the decades, adapting to the changing economic landscape and the country’s evolving role within the European Union. Historically, Spain’s journey from a closed economy under dictatorship to a liberalized market economy in the European context has necessitated numerous reforms in its tax system. Following Spain’s accession to the European Economic Community in 1986, the corporate tax system began aligning with European standards, leading to a series of reforms aimed at modernization and harmonization with international practices.

The evolution of the corporate tax system in Spain can be chronicled in distinct phases. Initially, the focus was on reducing high nominal rates and broadening the tax base to create a more efficient tax structure. Reforms in the early 1990s simplified the tax rate structure and reduced the top rates to foster investment and competitiveness. The subsequent period saw efforts to combat tax evasion and avoidance, culminating in a more robust and transparent corporate tax system.

The financial crisis of 2008 precipitated another wave of tax reforms, with a dual aim of increasing revenues and promoting economic recovery. Measures included adjustments to tax rates, the introduction of new deductions, and incentives designed to stimulate growth and employment. In the aftermath, Spain faced the challenge of balancing fiscal consolidation with the need to maintain an attractive environment for business and investment.

The current structure of Spain’s corporate tax system is a product of these continuous reforms. As of the latest updates, the standard corporate tax rate stands at a competitive level compared to the EU average, aiming to attract foreign direct investment and foster domestic economic activity. The tax system includes a variety of deductions and credits, with particular emphasis on innovation, research and development, and environmental sustainability.

Spain has also implemented measures to align with the Base Erosion and Profit Shifting (BEPS) project initiated by the OECD. These include regulations on transfer pricing, controlled foreign company (CFC) rules, and limitations on the deductibility of financial expenses.

Methodology

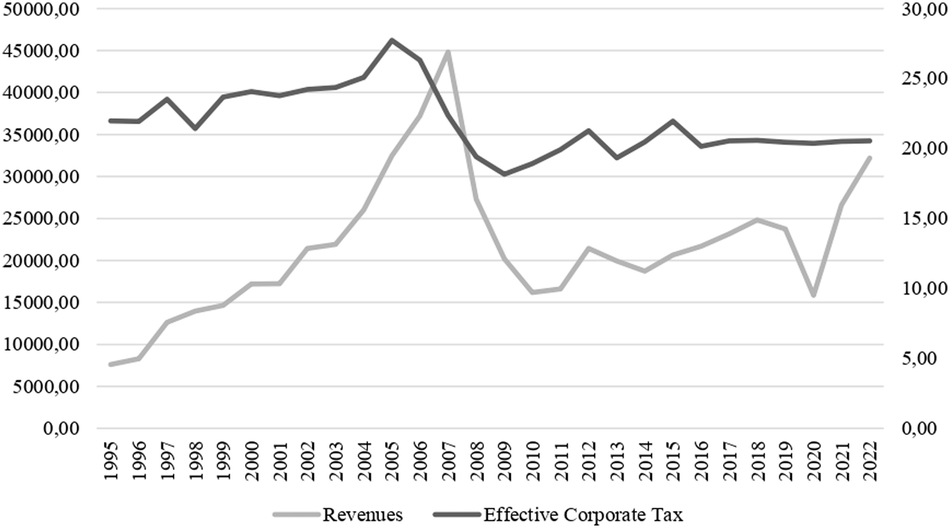

This study employs a quantitative approach to analyze the efficiency of Spain’s corporate tax system using regression analysis and time-series data. This study utilizes a dataset tailored for examining corporate taxes in Spain, comprising key variables such as fiscal revenues, effective tax rates, and time periods.

The empirical model involves regressing the logarithm of fiscal revenues on the effective tax rate and its squared term. This approach facilitates the identification of the Laffer curve’s inflection point. Subsequently, the study delves into the Laffer curve analysis. This involves a more complex regression where the square of the effective tax rate is included to capture the non-linear relationship between tax rates and tax revenues.

Application of the Laffer Curve

The regression analysis employed in this study aims to elucidate the relationship between corporate tax rates and tax revenues within the framework of the Laffer curve. This analysis is crucial for identifying the optimal tax rate that maximizes revenue. The ordinary least squares (OLS) regression model is used due to its simplicity and effectiveness in estimating linear relationships.

The results suggest a nuanced understanding of tax policy is required. While there is evidence of a Laffer curve effect, indicating that too high a tax rate could diminish revenues, the exact point at which this occurs is not definitively identified by this model. It’s important to note the limitations of this analysis. The lack of a strong statistical significance in the overall model and the moderate explanatory power imply that caution should be exercised in drawing definitive policy conclusions.

Buoyancy Index Analysis

In this study, we delve into the Buoyancy index as a crucial tool for comprehending the responsiveness of Spanish corporate tax revenues to fluctuations in the economic base. This index serves as a valuable indicator of the elasticity of fiscal revenues relative to underlying economic activity.

Our analysis encompassing 27 observations reveals a mean Buoyancy index value of 0.110. This finding implies that, on average, the growth of fiscal revenues surpasses that of the tax base by a marginal margin. A value slightly above zero suggests a relatively proportionate relationship between revenue growth and the growth of the tax base, indicating that the current tax system exhibits a moderate degree of responsiveness to changes in economic conditions.

The Buoyancy index further complements this finding, displaying a mean value that indicates a relatively proportional response of tax revenue growth to the tax base growth. Nonetheless, the variability and extreme values in certain years suggest moments where the tax system’s responsiveness has significantly fluctuated.

Discussion

The analysis informed by the polynomial regression indicative of the Laffer curve suggests a narrative of a corporate tax system potentially approaching its revenue-maximizing threshold. The negative coefficient for the linear tax rate term and a positive coefficient for the squared tax rate term highlight the presence of a revenue-maximizing tax rate, beyond which any increase could lead to lower tax revenues.

The Buoyancy index further complements this finding, displaying a mean value that indicates a relatively proportional response of tax revenue growth to the tax base growth. Nonetheless, the variability and extreme values in certain years suggest moments where the tax system’s responsiveness has significantly fluctuated.

In light of these findings, future research could benefit from exploring additional variables that might influence tax revenues, such as economic growth, tax compliance rates, and administrative efficiency. Also, extending the analysis to a broader dataset or employing different econometric techniques could provide more robust insights into the nature of the Laffer curve in the context of Spain’s corporate tax system.