**Eurobank Exceeds Expectations, Eyes Regional Dominance with Cyprus as a Key Hub**

Eurobank has reported stellar financial results for 2023, outperforming initial projections and laying the groundwork for an ambitious business plan for the next three years. The bank aims to solidify its status as a regional banking leader, with Cyprus playing a pivotal role in its expansion strategy.

The bank’s board of directors is scheduled to convene in Cyprus from March 20-22, underscoring the island’s strategic importance. Eurobank’s 2023 performance boasted a net profit per share of €0.31 and an 18.1% return on equity, with earnings per share climbing to €2.07—a 21.1% increase from the previous year. International operations contributed a substantial 37% to net profits, highlighting the bank’s global reach.

Eurobank’s robust financial health is reflected in its Capital Adequacy Ratio (CAD) of 20.2% and a Common Equity Tier 1 (CET1) ratio of 17%. Non-performing exposures (NPEs) remained low at 3.5%, with a strong coverage ratio for non-performing loans at 86.4%. The bank also demonstrated liquidity strength with a loans-to-deposits ratio of 72.3% and a liquidity coverage ratio of 178.6%.

Looking ahead, Eurobank’s business plan for 2024-2026 focuses on thriving in a lower-interest-rate environment, integrating Hellenic Bank in Cyprus, expanding regional presence, and diversifying revenue streams. The bank anticipates that international operations will account for about 50% of profits, with a target capital return of approximately 15% and a gradual increase in dividend payout ratio to nearly 50% by 2026.

Net interest income surged by 46.9% in 2023 to €2.17 billion, primarily driven by loan revenues, bonds, derivatives, and international activities. Fee and commission income grew by 4.2%, totaling €544 million.

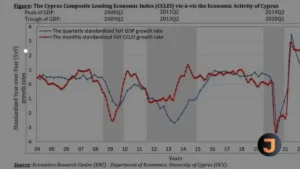

Eurobank’s CEO Fokion Karavias highlighted the favorable macroeconomic conditions in Greece, Cyprus, and Bulgaria, which are outpacing the Eurozone average growth rates. The bank’s strategic acquisitions in these regions are set to bolster its market position.

Stavros Ioannou, Deputy CEO and COO, emphasized Eurobank’s diversified business model and commitment to digital infrastructure, with over €200 million invested in technology over the past three years. Michalis Louis, CEO of Eurobank Cyprus, pointed to the bank’s distinguished service and customer-centric approach as key differentiators in the market.

Eurobank’s growing presence in Cyprus is expected to serve as a European gateway for businesses from the Middle East and India. The bank’s strategic moves, including the integration of Hellenic Bank and initiatives in the energy sector, are poised to support Cyprus’s economy and enhance its regional service center status.

In international relations, Eurobank has partnered with NPCI International Payments Limited (NIPL) to streamline remittances from Greece to India, leveraging UPI technology for efficient cross-border transactions.

Eurobank’s impressive results and strategic vision position it as a dynamic force in regional banking, with Cyprus central to its plans for continued growth and market leadership.