Anticipating the Fed’s Next Move: A Week of Crucial Decisions

Investors and traders are poised for a critical week as they seek to discern the Federal Reserve’s forthcoming monetary policy actions. With adjustments already visible in the US equity and fixed income markets, all eyes are on the anticipated event that could set the trajectory for future Fed rate cuts. Despite Wall Street’s reduced rate cut bets for this year, optimism remains high for 2025.

The challenge of controlling inflation amidst economic turbulence post-COVID-19 has been formidable for the Fed. Recent data on producer and consumer prices have signaled that inflation, previously thought to be easing towards the Fed’s target rate of 2%, may be plateauing, raising concerns among market participants.

Fed Chairman Jerome Powell previously hinted at a potential reevaluation of the inflation target during his Senate and House testimony, acknowledging that COVID-19 has permanently altered inflation dynamics. This week, as Powell takes center stage to announce the monetary policy decision, traders will be keenly listening for any indications of future rate cuts.

With inflation readings proving to be stubbornly high, expectations for aggressive interest rate reductions are waning. Goldman Sachs has already tempered its forecast, now predicting three rate cuts this year instead of four.

The Political Influence on Monetary Policy

As election year dynamics unfold, the possibility of Donald Trump’s return to office could influence the pace of rate cuts. Trump’s preference for lower interest rates is well-documented, and despite his advisory team’s hawkish Fed Chairman candidates, his presidency could exert pressure on the Fed to accelerate rate reductions to stimulate the economy.

Market Reactions: Stocks and Gold in Focus

US stock indices have experienced volatility, particularly with sell-offs among key tech giants. Any deviation from the current hawkish stance by the Fed could impact the stock market positively or negatively.

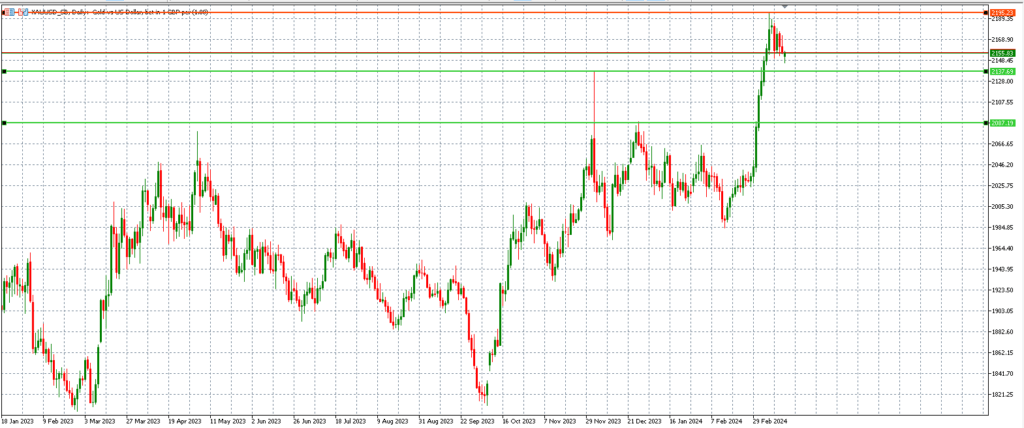

Gold, meanwhile, has seen its first weekly decline after three weeks of gains and new highs. The precious metal hovers near $2155, with its record high just a stone’s throw away at $2200. Support and resistance levels are clearly defined, with investors monitoring these thresholds closely.

As Chief Investment Officer at Zaye Capital Markets, Naeem Aslam provides insights into these market dynamics. However, it’s important to note that these views are his own and may not necessarily align with those of Zaye Capital Markets.