French politicians need to listen to bond markets – and keep them on side – or face a potentially catastrophic ‘Liz Truss scenario’, the CEO of a leading independent financial advisory and fintech has warned.

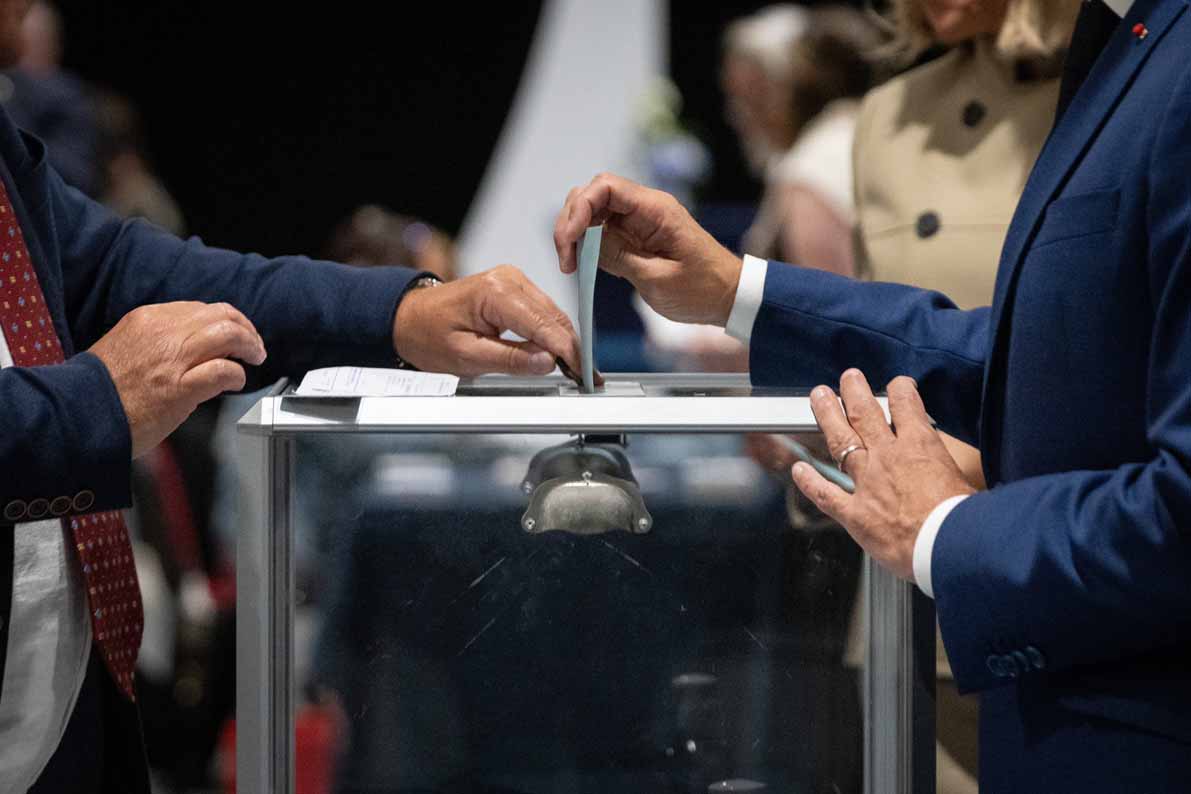

The stark warning from Nigel Green of deVere Group comes as the political chaos in France is driving the gap between French and German bond yields to widen to the most since the sovereign debt crisis. It follows the snap election called by President Macron, with the results confirming that no party has enough seats for a majority in parliament, plunging French politics into turmoil that could last months.

Voters in France mobilised to stop Marine Le Pen’s far right taking power. However, it was a close-run thing for the Left, anti-Le Pen coalition. “Given the recent election’s result of a hung parliament, any newly formed French government will face difficulties in pushing forward economic reforms or reaching an agreement on fiscal policies, as there are seemingly insurmountable differences regarding taxes and government expenditures,” said Green.

“France was already in a challenging fiscal situation to initiate an Excessive Deficit Procedure (EDP) against the country due to its failure to maintain its budget deficit below 3% of GDP.” The EDP is a measure by the European Commission against any EU member state that surpasses the budget deficit limit or does not sufficiently reduce its debt.

Tax Proposals

Green added that the tax and spending proposals from both the left-wing New Popular Front and the far-right Rassemblement National (RN, or National Rally) were major points of contention leading up to the snap election. “Bond markets demand fiscal orthodoxy and prudence. If French politicians fail to listen to bond markets they will be quickly punished and could face a catastrophic Liz Truss-style situation.”

Liz Truss was UK Prime Minister for just 49 days in 2022 after investors rejected an announcement by her government in a ‘mini budget’ that it would slash taxes while ramping up borrowing in a bid to produce faster growth, citing fears that the plan would push up inflation just as the Bank of England wants to bring it down. Concerns were also high about the sustainability of government debt at a time of rapidly rising interest rates.

“The pound crashed to a record low against the US dollar, meanwhile bond prices slumped, sending yields soaring. In turn this pushed mortgage rates much higher, and brought some pension funds to the brink of default,” the deVere CEO said. “The Bank of England was forced to announce three separate interventions to avoid a full-scale meltdown in the UK government bond market.”

Green concluded that, “it’s hard to see how the forces in France’s political gridlock will come to agree on fiscal matters. This could be dangerous. And the bond markets are watching through their fingers, fearing a Liz Truss scenario.”