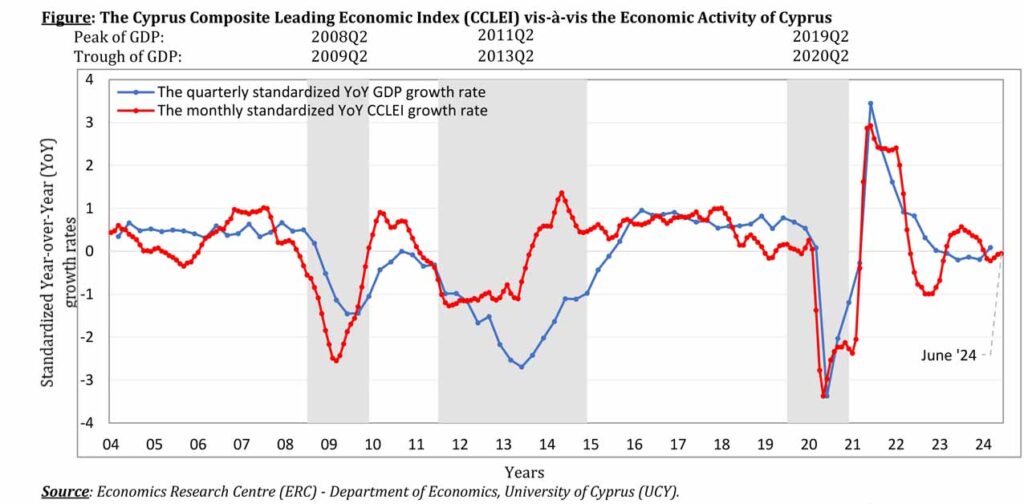

The year-over-year growth rate of a leading indicator used to predict the future direction of economic movements in Cyprus remained stable in June, as a result of opposing trends within the economic indicators composing the CCLEI, the University of Cyprus said in a monthly report.

The Cyprus Composite Leading Economic Index (CCLEI), estimated by the university’s Economics Research Centre (CypERC), remained stable in June, following the year-over-year decreases of 0.4% and 0.1% in April and May, respectively, based on recent and revised data.

Half of the variables positively affected the CCLEI during this period, while the rest restrained the further growth of the Index. Specifically, the year-over-year increase in tourist arrivals in Cyprus, credit card transactions, retail sales volume, and the Economic Sentiment Indicator (ESI) in the euro area had a positive impact on the CCLEI.

Conversely, the negative year-over-year growth rate of the ESI in Cyprus, coupled with the increase in international Brent crude oil prices and the decline in the year-over-year growth rate of property sales contracts and temperature-adjusted electricity production volume, had a negative impact on the CCLEI in June.

Understanding Lease Dynamics

In related economic activities, understanding lease dynamics can provide valuable insights into market trends. A lease, by

So, what is a lease? Essentially, it is a financial tool that allows companies to leverage assets such as property, machinery, or vehicles without purchasing them outright. The lease meaning extends beyond mere possession; it encompasses the strategic management of resources to optimize operational efficiency and financial planning.

In summary, while the CCLEI provides a snapshot of economic stability amidst fluctuating indicators, comprehending lease agreements offers businesses a pathway to sustainable growth and resource management.