Scrutiny Over Cyprus Banks’ Interest Rate Policies Intensifies

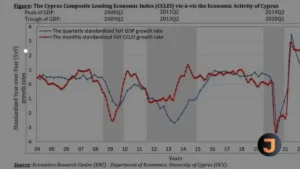

Amidst the backdrop of Cyprus banks posting a staggering 600% increase in profits, amounting to over €1.1 billion in 2023, concerns are rising over the impact of their interest rate policies on the local economy and the welfare of Cypriot savers and borrowers. Bank of Cyprus CEO, Panicos Nicolaou, recently claimed in a Bloomberg interview that “more than 90% of the bank’s profits come from businesses in the local market,” a statement that has been met with skepticism.

The surge in bank profits has been attributed to several factors. Notably, a significant portion of bank assets, around 35%, was parked at the European Central Bank (ECB), earning interest rates between 2% to 4% in 2023. This strategy contributed to a more than doubling of interest income for the two largest banks by €830 million between 2022 and 2023. Meanwhile, lending rates in Cyprus have soared above the euro area average, with house purchase loans averaging at 5.1% and corporate loans at 5.7% by December 2023.

Furthermore, while Cyprus banks benefit from a 4% interest rate on redeposits at the ECB, they offer customers a meager average interest rate of 2.06% on fixed term deposits as of January 2024. This suppression of deposit rates significantly below inflation rates has been a major contributor to the banks’ profit growth.

Questions also loom over the distribution of these profits, especially since foreign equity and investment funds hold substantial shares in major Cyprus banks. For instance, the Bank of Cyprus has announced that €112 million of its after-tax profit will be distributed as dividends, with an additional share buyback of up to €25 million.

In response to these developments, there is a call for ethical considerations and moral suasion from Cyprus authorities to encourage banks to offer fairer interest rates to depositors. The government is also urged to lower the defence tax on interest income from deposits to align with that on Cyprus government bonds.

Comparatively, Italy and Spain have imposed additional taxes on banks’ “windfall profits” in 2023, a measure that some suggest Cyprus should consider to ensure banks contribute more effectively to the real economy and customer welfare. Proposals include taxing 20% of net interest income from banks to support higher interest rates for savings schemes and subsidize loan interest rates for borrowers, especially targeting support for younger individuals striving for homeownership and family life.

Les Manison, a former senior economist at the International Monetary Fund and an ex-advisor in the Cyprus finance ministry, emphasizes the importance of ethical and equitable banking practices that support the real economy and provide fair returns and affordable loans to Cypriots.